Rare Element Reports Additional Drilling Results High in Critical Rare Earth Elements

- Details

- Category: Rare Earth News

- Published on Tuesday, 12 March 2013 08:57

- Written by Yuri

- Hits: 2770

Rare Element Resources Ltd. is pleased to announce rare earth element (REE) assay results from the final core holes completed during the 2012 drilling program at the Company’s 100% owned Bear Lodge property, located in northeastern Wyoming, USA. The drilling results confirm that the Bear Lodge deposits contain high grades of total rare earth oxide (TREO), including high abundances of combined Critical Rare Earth Oxides (CREOs).

Dr. James Clark, Vice President of Exploration for Rare Element Resources, states “Assay results are now in from all of the development and exploration core holes drilled during our 2012 program. We are extremely pleased with the results as most recent drill results confirm and further expand the quality and continuity of the Bull Hill REE deposit and the Whitetail Ridge resource area. We expect to significantly increase the Measured and Indicated resources in those deposits in preparation for the upcoming definitive Feasibility Study (dFS). Further, the results confirm the zones of HREE-enrichment (Eu, Tb, Dy, and Y) at Whitetail Ridge and Carbon and illustrate the significance of this world class source of CREOs.”

Critical Rare Earth Oxides (CREO)

Critical rare earth elements (CREEs) are those with the highest value, and for which the strongest future growth is projected. We refer here to the oxides of Nd, Pr, Eu, Tb, Dy, and Y as Critical Rare Earth Oxides (CREO). In 2011, the Company identified significant HREEs (Eu, Tb, Dy, and Y) in leached FMR (F (FeOx)-M (MnOx)-R (REE minerals)) and oxide-carbonate dikes at the Whitetail Ridge resource area, and at the East Taylor and Carbon target areas (see news releases dated 4 August and 27 October 2011, and 10 December 2012). The current set of assay results from the Whitetail Ridge resource area and Carbon target confirm those important observations. Examination of aggregate significant intercepts from past drill results and the current set of drill assay results indicate that there is a district-wide zonation in which the strongest TREO enrichment occurs within a central zone focused on the Bull Hill and Bull Hill Northwest deposits, while the strongest HREE (Eu, Tb, Dy and Y) enrichment is found in mineralization peripheral to the central zone and focused at the Whitetail Ridge deposit, and at the Carbon and Taylor REE target areas (Table 1 and Figure 2). The peripheral enrichment zone is ascribed to a late-stage, low-temperature hydrothermal event.

Objectives of the 2012 Drill Program

The objectives of the 2012 drilling program were to expand and upgrade the district’s resource categories at the Bull Hill and Whitetail Ridge oxide deposits, and to further delineate the HREE (Eu, Tb, Dy, and Y) enrichment at the Whitetail Ridge resource area and Carbon target area. The drill results emphasize a Bear Lodge district-wide REE zonation, with a central zone of strong TREO enrichment that gives way to a peripheral zone with significant TREO and strong Eu, Tb, Dy, and Y enrichment.

The assay results from 35 core holes are announced in this release and include assays from 15 core holes at the Bull Hill REE deposit, 18 holes from the Whitetail Ridge resource area, and 2 holes from the Carbon REE target area.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Rare Earth Market Traded Weaker

- Details

- Category: Rare Earth News

- Published on Monday, 11 March 2013 17:55

- Written by jiang

- Hits: 2583

Monday rare earth market is still deserted, traders slightly mobilize quotes, concentrated in the lanthanum, cerium, gadolinium. Most cargo operators who offer more stable.

Market quote a higher degree is still concentrated in the oxide, gadolinium oxide, praseodymium, neodymium, addition some traders Alerts cheap gadolinia, market inquiries and turnover of other oxides are weak. Insiders reflect gadolinium oxide is a tax 140,000 yuan / ton, there are many traders very price including tax 150,000 yuan / ton. Praseodymium neodymium oxide market tax price is still $ 31-32 million / ton, excluding tax 26.3-26.5 yuan / ton. The lanthanum cerium-based oxide prices are still down 39 lanthanum oxide tax 3.6-3.8 yuan / ton, 395 cerium oxide tax of 3.5-4 yuan / ton offer both. Lanthanum cerium metal offer more stable, Baotou traders tax offer 60,000 yuan / ton, the Ganzhou traders offer slightly higher.

Rare Earth Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Brief Introduction to Rare Earths

- Details

- Category: Rare Earth News

- Published on Monday, 11 March 2013 15:42

- Written by Yuri

- Hits: 2811

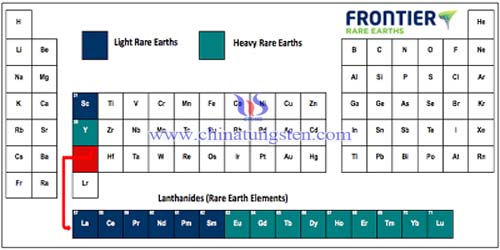

Rare earths is a term commonly used to describe the 15 chemically similar, lanthanide elements which appear together towards the bottom of the Periodic Table. Two other elements, yttrium and scandium, which have similar chemical properties, are often also referred to as rare earths. Rare earths can be divided into "light" rare earths and "heavy" rare earths and both are present to varying degrees in all rare earth deposits. Rare earths are therefore recovered and processed together before sequential separation into individual rare earth elements. Prices for individual rare earths in pure oxide form can vary significantly with, generally speaking, the heavy rare earths trading at higher values. It should be noted the highest value heavy rare earth elements, namely europium, terbium and dysprosium, are contained at elevated levels at Zandkopsdrift by comparison to a number of other similar deposits being evaluated globally. It is also noteworthy that both the thorium and uranium content of the Zandkopsdrift resource are relatively low, at average grades of 178ppm and 47ppm respectively.

The oxides produced from processing rare earths are collectively referred to as rare earth oxides. Although rare earths are relatively common in the earth's crust, they often do not occur in high enough concentrations (or occur along with high levels of radioactive elements) to make their extraction economic. The oxides that are produced from processing the rare earth elements constitute the basic material that can be sold to the market or further processed into metals or alloys.> Their location in the periodic table is shown below.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Rare Earth Market

- Details

- Category: Rare Earth News

- Published on Monday, 11 March 2013 15:56

- Written by Yuri

- Hits: 1574

Exact statistics are difficult to come by in the rare earths field, partly because there is no official statistics agency, partly because they rely on Chinese sources where smuggling occurs, and partly because the end uses are so disparate. The Industrial Mineral Corporation of Australia (IMCOA) are widely respected and gave some updated numbers in a November 2012 presentation.

The anticipated rare earth supply for 2012 was estimated at 112,500 tonnes of rare earth oxide against production of 106,000 tonnes. Global production of heavy rare earths at 7,000 tonnes was 40% below the estimated 10,000 tonnes demand with almost all of this being produced in China. Global demand is expected to increase to 160,000 tonnes by 2016 and to 220,000 tonnes in 2020. Demand for heavy rare earths is expected to increase 45% but supply expected to remain static at 7,000 tonnes.

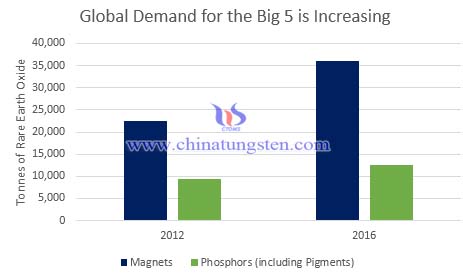

The five elements which drive the economics of rare earth production (what Frontier calls the “Big 5” are neodymium, praseodymium, dysprosium, terbium and europium. The two demand sectors which consume the majority of these elements’ production are magnets and phosphors. IMCOA sees demand for these increasing rapidly, which will help to support their prices while other elements – such as lanthanum and cerium – may be in oversupply.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Rare Earths in China

- Details

- Category: Rare Earth News

- Published on Monday, 11 March 2013 15:31

- Written by Yuri

- Hits: 2731

China is effectively the monopoly supplier of rare earth elements in the world today. It became the dominant supplier by producing and supplying rare earths in the 1990s and early 2000s at a price western producers could not compete. As a result China anticipated Chinese production in 2012 is 96,000 tonnes according to a November 2012 presentation by industry consultants Industrial Minerals Corporation of Australia (IMCOA).

Chinese demand for rare earths has also continued to rise with organic growth for current applications and new applications have been found for many of the elements and in 2012 this is estimated to be 69% of global demand, or 79,000 tonnes. This is expected to rise to 107,000 tonnes by 2016. At the same time, China’s supply of rare earths is expected to fall as China tightens up environmental controls and curb illegal mining.

The Chinese government is actively trying to consolidate the rare earth industry into major mining groups to assert state control over the supply of rare earths which it views as a strategic asset. These groups will centre on the 3 main rare earth production areas in China:

BaoTou Hi-Tech representing the Inner Mongolia government is taking the lead in the BaoTou area which predominantly produces light rare earths

JiangXi Copper Corp is taking the lead in consolidation in the Sichuan area which produces mainly light rare earths

In the Ionic clay region in the south of China it is expected that consolidation will result in 3 producing groups, China Minmetals, Chinalco and China Mining. This is where most of China’s heavy rare earths will be produced

As a consequence of the rising demand and limited supply China has introduced export quotas which have limited the supply of rare earths to the rest of the world. The Chinese export quota has been reduced substantially since 2005, from 65,580 tonnes to 30,996 tonnes in 2012.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com