Northcliff Shares Climbs on Strong Economics at Sisson Tungsten Project

- Details

- Category: Tungsten's News

- Published on Thursday, 31 January 2013 11:30

Northcliff Resources (NCF-T) has shone a spotlight on its Sisson tungsten-molybdenum project in New Brunswick with a feasibility study yesterday confirming it could economically mine the deposit for 27 years, sending its shares climbing.

Northcliff gained 33% or 10¢ on the news to end at 40¢. It added another 12.5% today to close at 45¢.

The study, prepared by Denver-based Samuel Engineering, demonstrates Sisson could annually produce 557,000 metric tonne units of tungsten trioxide (WO3) in ammonium paratungstate (APT) and 4.1 million lbs. molybdenum in concentrate for 27 years, with output for both metals trending higher in the initial years.

The study, prepared by Denver-based Samuel Engineering, demonstrates Sisson could annually produce 557,000 metric tonne units of tungsten trioxide (WO3) in ammonium paratungstate (APT) and 4.1 million lbs. molybdenum in concentrate for 27 years, with output for both metals trending higher in the initial years.

Annual production for the first five years should average 698,000 mtu WO3 and 4.1 million lbs. molybdenum, the company says, noting Sisson could potentially become the largest tungsten producer outside China.

The large-scale project comes with a $579-million price tag, which Northcliff estimates will take four and half years to recoup on an after-tax basis. Sisson has a post-tax net present value of $418 million and an internal rate of rate of 16.3%.

Depending on financing as well as environmental and construction permits, the construction of the project should begin next year with commissioning slated for 2016.

The company’s president and CEO Chris Zahovskis said he’s “confident” that Sisson will receive a green light from regulators to start construction in 2014, adding he is actively seeking strategic partners for Sisson to help fund the project.

According to a recent corporate presentation, Sisson has one of the largest tungsten reserves outside China. It is currently the biggest tungsten development project in the global pipeline, with Masan Resources’ Nui Phao project in Vietnam in second, followed by Woulfe Mining’s (WOF-V) Sangdong deposit in South Korea.

Sisson boasts 334 million tonnes of reserves containing 22 million mtu WO3 and 155 million lbs. molybdenum at a net smelter return cutoff grade of $8.83 per tonne.

But the mine plan incorporates only 281 million tonnes of the current reserves, which should be processed at a milling rate of 30,000 tonnes per day throughout the mine life. The proposed open-pit mine has a low strip rate of 1-to-1.

The study assumes long-term average metal prices of US$350 per mtu for ATP and US$15 per lb. for molybdenum, which falls in the “low-to-medium range” of estimates provided by the London-based Roskill Consulting Group, says Northcliff.

Long-term tungsten prices are forecast to increase “irrespective of the supply/demand balance,” Northcliff writes quoting a report by Roskill, which explains tungsten production costs have been climbing globally causing Chinese producers to be more sensitive than before to higher costs for labour, equipment and consumables.

In real price terms, ATP prices are projected to average US$383 per mtu from 2012 to 2025, hitting $433 per mtu in 2025.

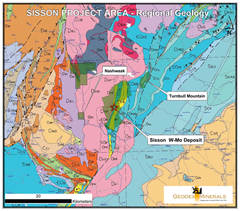

Northcliff highlights the Sisson project, sitting 100 km northwest of Fredericton, is well-positioned near roads, rail and tidewater and is in a stable mining jurisdiction.

“By advancing Sisson, Northcliff will become one of North America’s major tungsten producers, greatly increasing supply for the large North American, Asian and European markets where demand is forecast to outstrip supply,” it says.

Tungsten Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com