Tungsten and Cobalt Prices Rise in Turn, Cemented Carbide Firms Struggle

- Details

- Category: Tungsten's News

- Published on Friday, 26 September 2025 17:27

Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices were under downward pressure this week due to increased profit-taking by holders and slow restocking by buyers, widening the market's negotiable space. Furthermore, price reductions announced by major tungsten companies during the week further impacted market sentiment.

However, compared to the previous surge, this correction was relatively moderate. With the Mid-Autumn Festival and National Day holidays approaching, industry insiders generally expect the market to remain cautious and under pressure before the holidays. Further attention will be paid to policy news and downstream restocking.

In the tungsten concentrate market, short-term supply and sentiment are temporarily easing, leading to a downward trend in trading. Long-term focus remains on the scarcity and strategic nature of tungsten resources, and a long-term upward outlook remains.

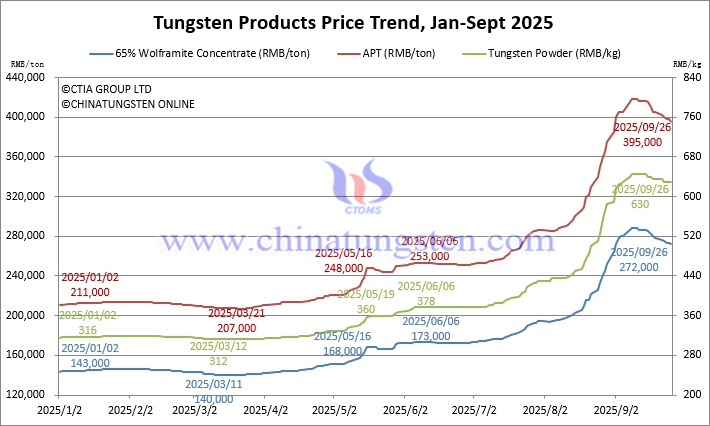

The price of 65% wolframite concentrate was reported at RMB 272,000/ton, down 2.2% week-on-week and up 90.2% year-on-year.

The price of 65% scheelite concentrate was reported at RMB 271,000/ton, down 2.2% week-on-week and up 90.9% year-on-year.

The ammonium paratungstate (APT) market saw relatively quiet buying and selling sentiment. Market confidence declined due to sluggish upstream ore prices and downstream consumer resistance, leading to a downward adjustment in transaction prices as tungsten companies adjusted their long-term purchase prices.

The price of ammonium paratungstate (APT) was reported at RMB 395,000/ton, down 2.5% week-on-week and up 87.2% from the beginning of the year.

The European APT price was reported at USD 570-650/mtu (RMB 360,000-410,000/ton), up 2.1% week-on-week and up 84.9% from the beginning of the year.

In the tungsten powder market, a risk-averse atmosphere prevailed, with trading remaining stagnant and maintaining a one-on-one negotiation strategy. Cemented carbide companies saw a slight improvement in their bargaining power for tungsten raw materials, but cobalt cost pressures increased significantly during the week.

The price of tungsten powder was reported at RMB 630/kg, down 0.8% week-on-week and up 99.4% from the beginning of the year.

The price of tungsten carbide powder was RMB 615/kg, down 0.8% week-on-week and up 97.8% from the beginning of the year.

The price of cobalt powder was RMB 380/kg, up 16.9% week-on-week and up 123.5% from the beginning of the year.

In the ferrotungsten market, overall market enthusiasm has cooled due to cost easing and a slight decline in international prices, and the market trend has shifted downward.

The price of 70% ferrotungsten was RMB 390,000/ton, down 2.5% week-on-week and up 81.4% from the beginning of the year.

The European ferrotungsten price was USD 80-82/kg W (equivalent to RMB 399,000-409,000/ton), down 3.4% week-on-week and up 84.1% from the beginning of the year.

In the tungsten waste and scrap market, due to a rational market sentiment on the raw material side, the decline narrowed significantly this week. The market maintained a certain level of liquidity, and a cautious wait-and-see atmosphere prevailed.

The price of scrap tungsten bar was RMB 385/kg, flat week-on-week and up 75% from the beginning of the year.

The price of scrap tungsten drill bits was reported at RMB 370/kg, unchanged from the previous week and up 62.3% from the beginning of the year.

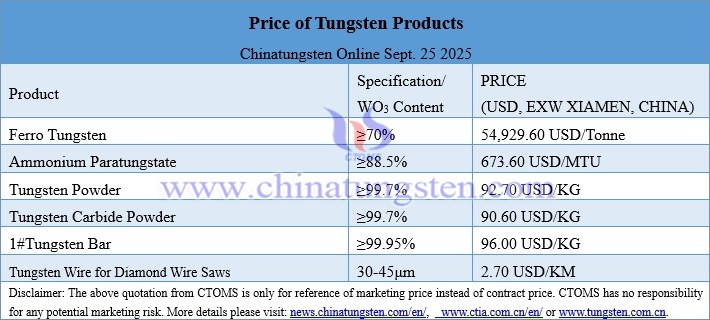

Prices of Tungsten Products on September 26, 2025

Tungsten Price Trend from January to September 26, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com