APT and Tungsten Carbide Powder Prices Under Pressure - September 23, 2025

- Details

- Category: Tungsten's News

- Published on Tuesday, 23 September 2025 16:38

Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices remained under pressure, and market activity was sluggish. Long-term order quotations from major tungsten companies in Fujian and Jiangxi Provinces were released one after another, with a weakening trend impacting overall market sentiment. While panic selling on the tungsten raw material side hasn't occurred, the market continues its downward trend due to cyclical fluctuations in supply and demand.

The tungsten concentrate market is performing slightly weaker, with reduced risk appetite among traders leading to slower market circulation and a continued stalemate between buyers and sellers.

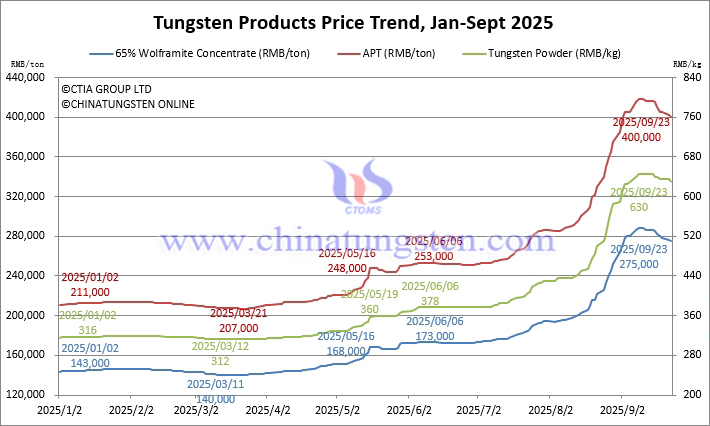

The price of 65% wolframite concentrate was reported at RMB 275,000/ton, down 4.5% from its peak and up 92.3% from the beginning of the year.

The price of 65% scheelite concentrate was reported at RMB 274,000/ton, down 4.5% from its peak and up 93% from the beginning of the year.

The ammonium paratungstate (APT) market is adjusting in line with market conditions. Due to continued pressures from both costs and demand, and continued export restrictions, securing new orders is difficult, maintaining a strong wait-and-see attitude.

The price of ammonium paratungstate (APT) was reported at RMB 400,000/ton, down 4.3% from its peak and up 89.6% from the beginning of the year.

The European price of APT was reported at USD 550-645/mtu (equivalent to RMB 346,000-406,000/ton), up 81.1% from the beginning of the year.

The tungsten powder market was cautious in negotiations based on orders. The transmission of cost factors to downstream markets was relatively slow, leading to strong risk aversion among participants and insufficient buying and selling momentum.

The price of tungsten powder was reported at RMB 630/kg, down 2.3% from its peak and up 99.4% from the beginning of the year.

The price of tungsten carbide powder was reported at RMB 615/kg, down 2.4% from its peak and up 97.8% from the beginning of the year.

The ferrotungsten market declined slightly, with both domestic and foreign markets retreating from their highs due to lower costs and cooling trading volumes.

The price of 70 ferrotungsten was reported at RMB 395,000/ton, down 3.7% from its peak and up 83.7% from the beginning of the year.

European ferrotungsten prices are reported at USD 80-84/kg W (RMB 398,000-418,000/ton), down 2.2% from their peak and up 86.4% from the beginning of the year.

The selling sentiment in the tungsten waste and scrap market have eased slightly, but price pressure remains widespread. The market continues to adjust downward, with the decline narrowing somewhat.

The price of scrap tungsten bars is reported at RMB 385/kg, down 13.5% from its peak and up 75% from the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 370/kg, down 18.7% from its peak and up 62.3% from the beginning of the year.

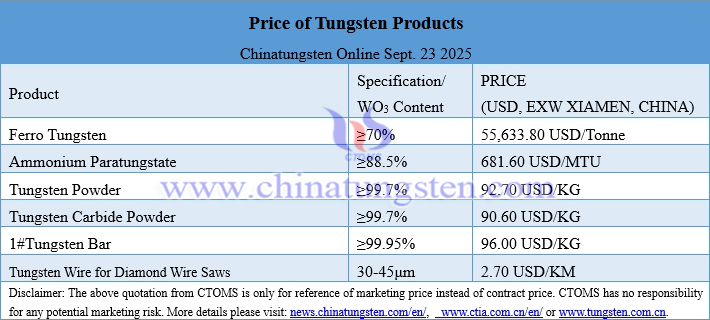

Prices of Tungsten Products on September 23, 2025

Tungsten Price Trend from January to September 23, 2025

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com