Molybdenum Market - August 28, 2025

- Details

- Category: Tungsten's News

- Published on Thursday, 28 August 2025 16:41

Molybdenum market update on August 28, 2025

The domestic molybdenum market is maintaining a relatively strong performance.

On one hand, the price of ferromolybdenum continues to show a slight upward trend, providing certain support to the upstream of the industrial chain. On the other hand, the issue of tight raw material market supply has not been effectively alleviated. Under the combined effect of these two bullish factors, most molybdenum mining enterprises have adjusted their pricing strategies, with quote levels re-entering an upward channel. Today, the prices of molybdenum concentrate and ferromolybdenum increased by approximately 30 yuan per ton-unit and 2,000 yuan per ton, respectively.

According to CTIA GROUP LTD Online statistics, as of now, this year, the price of molybdenum concentrate has increased by approximately 930 yuan per ton-unit, a rise of 25.83%; the price of ferromolybdenum has increased by about 57,000 yuan per ton, a rise of 24.46%; the price of molybdenum oxide has increased by approximately 930 yuan per ton-unit, a rise of 25.14%; the price of sodium molybdate has increased by about 38,000 yuan per ton, a rise of 23.17%; the price of ammonium tetramolybdate has increased by approximately 46,000 yuan per ton, a rise of 20.54%; the price of ammonium heptamolybdate has increased by about 46,000 yuan per ton, a rise of 20.18%; the price of molybdenum powder has increased by approximately 85 yuan per kilogram, a rise of 20.00%; and the price of molybdenum bars has increased by about 55 yuan per kilogram, a rise of 11.96%.

Some industry insiders predict that in the second half of 2025, the domestic molybdenum market’s fundamentals will remain in a tight balance, with prices likely to show steady operation and strong resilience. From the supply side, there are no plans for large-scale new capacity additions or releases from domestic and international molybdenum mines in the near term. Additionally, some domestic and international molybdenum mines face multiple supply constraints: the grade of raw ore is on a declining trend, compounded by safety and environmental control pressures from the high-temperature rainy season, as well as issues with excessive impurity elements in some ores, which will limit the release of additional supply from existing capacities to some extent. From the demand side, on one hand, high-end alloy sectors such as wind power bearings and LNG storage tanks have significant molybdenum consumption; on the other hand, with the rapid development of industries like wind power, photovoltaics, and energy storage, the market demand for molybdenum is expected to increase.

In terms of news, according to data from the China Iron and Steel Association, in mid-August 2025, the steel inventory of key statistical steel enterprises reached 15.67 million tons, increased by 0.6 million tons from the previous period, a rise of 4.0%; increased by 3.3 million tons compared to the beginning of the year, a rise of 26.7%; increased by 0.01 million tons compared to the same period last month, a rise of 0.1%; decreased by 0.78 million tons compared to the same period last year, a drop of 4.7%; and decreased by 0.96 million tons compared to the same period two years ago, a drop of 5.8%.

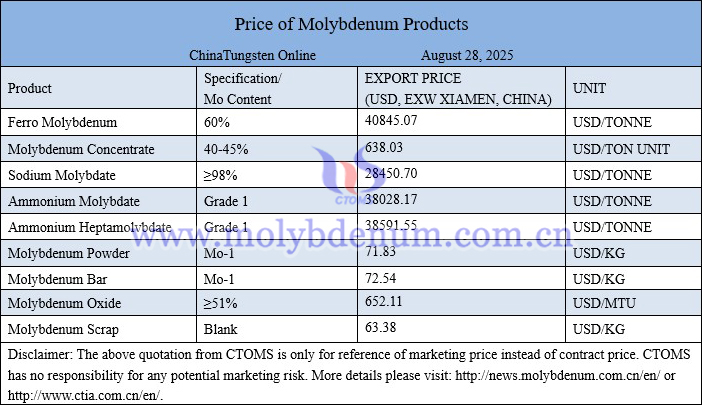

Price of molybdenum products on August 28, 2025

Molybdenum crucible picture

Follow our WeChat to know the latest tungsten price, information and market analysis.

| Molybdenum Supplier: Chinatungsten Online www.molybdenum.com.cn | Tel.: 86 592 5129595/5129696 Email:sales@chinatungsten.com |

| Tungsten News & Prices: Chinatungsten Online news.chinatungsten.com | Molybdenum News & Molybdenum Price: news.molybdenum.com.cn |

sales@chinatungsten.com

sales@chinatungsten.com