Why are Tungsten Prices Skyrocketing?

- Details

- Category: Tungsten's News

- Published on Tuesday, 19 August 2025 15:59

The questions we've been asked most recently are:

Why will tungsten prices skyrocket in 2025?

How can the tungsten supply shortage be resolved?

How will new energy and military demand affect the tungsten market?

What impact will export control policies have?

What are the future trends for tungsten prices?

...

As a professional company with over 30 years of experience in tungsten production and operations within the tungsten industry chain and providing information services for the tungsten and molybdenum industries, China Tungsten Online believes that the historic surge in tungsten prices in 2025 is the result of a convergence of multiple factors. This surge is not accidental, but rather the product of a multifaceted convergence of forces, including global supply chain adjustments, geopolitical tensions, a surge in emerging demand, and domestic policy adjustments.

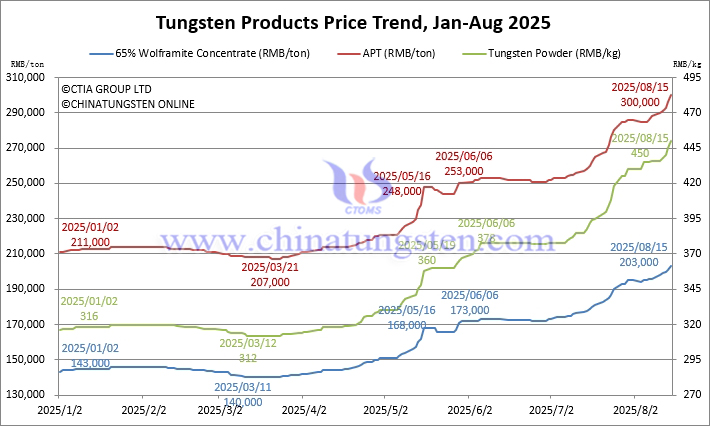

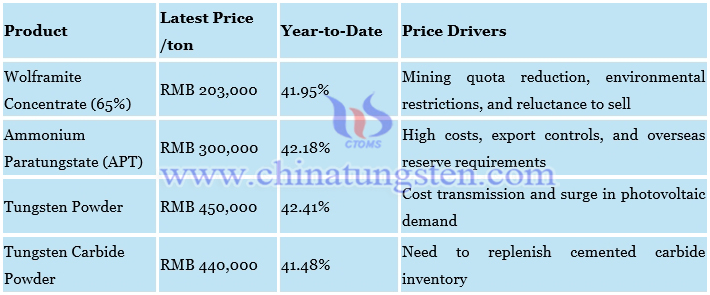

As of August 15, 2025, the price of tungsten concentrate soared from RMB 143,000/ton at the beginning of the year to RMB 203,000/ton. The price of ammonium paratungstate (APT) rose to RMB 300,000/ton, and the price of tungsten powder reached RMB 450,000/ton. This represents a 42% price increase across the entire supply chain, both reaching record highs. Meanwhile, European APT quotes have reached RMB 320,000/ton, and the price gap between domestic and foreign markets has gradually narrowed after reaching a record high this year. This surge in tungsten product prices can be attributed to the following four core factors, which reinforce each other, creating a "perfect storm" of price increases.

I. Continuous Supply-Side Contraction: Resource Depletion and Policy Restrictions

As a globally scarce resource, tungsten's supply-side capacity constraints have become the primary driver of the surge in prices. By 2025, China, a dominant country accounting for over 80% of global tungsten production, will further tighten mining policies and strengthen export controls, widening the global supply gap. Furthermore, the supply constraints on tungsten resources are also reflected in the unwillingness of leading companies, which control resources, to release large quantities of resources into the market despite low overall capital costs. This trend is exacerbated by deteriorating resource endowments and high environmental pressures.

1.1 Mining Quota Reduction and High Environmental Pressure

In 2025, the Ministry of Natural Resources' initial tungsten mining quota will be only 58,000 tons, a year-on-year decrease of 6.5% (approximately 4,000 tons). Jiangxi, a major producing region (accounting for 60% of China's production), will see its quota reduced by 2,370 tons, while quotas in low-producing regions such as Hubei and Anhui will be nearly zero. Furthermore, high environmental pressures, including tailings pond management and upgraded wastewater discharge standards, will significantly increase mining, resumption of production, and smelting and processing costs, further suppressing supply elasticity.

1.2 Deteriorating Resource Endowment

The average grade of tungsten ore in China has dropped from 0.42% in 2004 to 0.28% in 2024. Mining one ton of tungsten concentrate requires processing hundreds of tons of raw ore, pushing overall costs to new highs.

Globally, tungsten resource depletion is also a prominent issue. Some historic tungsten mines (such as Nui Phao in Vietnam, Panasqueira in Portugal, Cantung in Canada, and Mittersill in Austria) face high costs due to declining ore grades and aging equipment. While tungsten development projects in Europe, the United States, and South Korea (such as Barruecopardo in Spain, Mactung in Canada, Mount Carbine in Australia, and Sangdong in South Korea) are progressing, their output is limited and cannot offset China's production cuts. New exploration results are limited, and projects such as South Africa's RHA Tungsten continue to be delayed due to funding and technical issues, exacerbating global supply shortages. Export controls on Chinese tungsten resources and even minor fluctuations in demand can trigger significant price increases.

In the short term, the low average grade of tungsten ore and the shortage of primary tungsten resources will not fundamentally improve until new mines such as the Jiangxi Dahutang Tungsten Mine, which holds 1.2 million tons of resources, achieve large-scale production.

II. Explosive Demand: Driven by Emerging Sectors and Strategic Reserves

Growth in demand is another major driver of the surge in tungsten prices. By 2025, global tungsten demand, calculated as tungsten concentrate, is expected to reach over 130,000 tons, a year-on-year increase of 6%. The increase in demand for tungsten resources will primarily come from new energy, military, and high-end manufacturing sectors. The high elasticity of emerging demand and the steady growth of traditional demand are creating a synergistic effect.

2.1 Surge in Demand for Photovoltaics and New Energy

Photovoltaic tungsten filament for crystalline silicon cutting diamond wire is a new application of tungsten metal that has emerged in recent years. The penetration rate of photovoltaic tungsten filament has risen from 20% in 2024 to 40% in 2025 and continues to rise rapidly. Global demand is expected to exceed 4,500 tons in the future. China's photovoltaic production capacity accounts for 80% of the world's total, driving a 22% increase in tungsten filament demand. Tungsten wire is used in photovoltaic silicon wafer cutting, replacing traditional steel wire and significantly improving cutting efficiency.

In the power battery sector, tungsten is added to lithium battery cathodes to increase energy density. Consumption is expected to increase by 22% year-on-year to 1,500 tons in 2025. As new energy vehicle sales continue to grow, the use of tungsten in battery stabilizers will further expand, creating a new consumer segment for tungsten products even larger than diamond wire for photovoltaic cutting.

In the wind power and hydrogen energy sectors, tungsten alloys are used in turbine blades and catalysts, and demand has grown rapidly in recent years. China Tungsten Online analyzes that these emerging demands are driving tungsten consumption to expand beyond traditional cutting tools while also shifting its focus to high-tech applications.

2.2 High-end Manufacturing and Strategic Projects

The commercialization of nuclear fusion is accelerating (e.g., demand for the WEST device in France, the establishment of China Fusion Energy Corporation on July 22, and the ongoing construction of the Compact Fusion Energy Experimental Facility (BEST) and the Critical Systems Integrated Research Facility (CRAFT) in Hefei, based on the East Super Ring (EAST) device). China aims to complete a fusion engineering test reactor by 2035 and a commercial fusion demonstration reactor by 2050, completing humanity's ultimate energy transition. China's nuclear fusion market is expected to demand over tens of thousands of tons of tungsten products, including high-performance tungsten alloys and high-entropy alloys containing tungsten and molybdenum.

Demand for structural components for drones in the military, power construction, and maintenance, as well as national-level projects such as the Yarlung Zangbo River Hydropower Station and the Xinjiang-Tibet Railway, are driving demand for cemented carbide. Furthermore, the upgrade of trunk highways supporting these two major infrastructure projects will also generate sustained demand for cemented carbide. The development, mass production, and continuous upgrades of my country's large and military aircraft, particularly fifth- and sixth-generation aircraft, will continue to drive demand for cemented carbide in high-end manufacturing, such as aircraft engines and semiconductor equipment, and will also drive demand for high-performance tungsten. Demand for alloys continues to grow.

Of course, if the Red Flag Canal, a project that continues the Chinese nation's millennia-old wisdom in water management, were truly implemented, the total investment would likely reach a record RMB 5 trillion. This would generate enormous and irreplaceable demand for tungsten products, especially cemented carbide products. Lesser known is that my country's world-leading ultra-high voltage transmission and transformation equipment also places a significant and stable demand on tungsten alloys for their high-temperature electrical conductivity.

2.3 Global Strategic Reserve Competition

The military applications and strategic attributes of tungsten products are well known. These applications, including those mentioned above, not only drive continued demand growth but also increase reserves due to their strategic nature. The EU, the US, and other countries are actively promoting strategic reserve programs for key raw materials, including tungsten, intensifying competition for strategic resources such as tungsten and rare earth elements. China's export controls have further exacerbated international supply shortages.

III. Policy and Cost: Export Controls and Rigid Cost Support

Policy regulation and cost transmission are institutional factors driving tungsten price increases. In 2025, China's tightening export policies will resonate with global energy price fluctuations, pushing the price center upward.

3.1 Export controls exacerbate the price gap between domestic and foreign markets.

On February 4, 2025, my country issued an export control announcement regarding tungsten, tellurium, bismuth, molybdenum, and indium-related items, implementing a "one-item, one-certificate" export control system for 25 rare metal products and technologies, including ammonium paratungstate. This export control has led to a sharp decline in Chinese exports of tungsten products, particularly intermediate smelted tungsten oxide products, significantly impacting the tungsten supply chain in Europe and the United States. To ensure tungsten supply to the United States and its allies for critical sectors such as defense and aerospace, some North American mining companies are actively seeking to expand their tungsten mining and processing operations. However, this has been insufficient to meet the urgent needs of overseas suppliers. As inventories are digested, the shortage of tungsten products is rapidly widening. As of August 14, 2025, the European APT price was $485-503 per ton (RMB 308,000-319,000 per ton), a 49.7% increase from the beginning of the year.

Another factor contributing to the widening price gap between Chinese and foreign tungsten products is Western countries' own excessive demands, forcing Chinese suppliers to spend considerable sums to prove that 80% of the tungsten products originating in China, a crucial strategic material they desperately need (3TG), do not originate from war-torn regions in Africa, where such resources are completely unavailable.

3.2 Power and Environmental Protection Cost Transmission

Although China's electricity and other power costs are relatively stable, and low industrial electricity prices have alleviated some of the pressure on power costs, mining costs continue to rise. The price of 65% wolframite concentrate has exceeded RMB 200,000/ton (a 42% increase this year), directly driving up prices for tungsten products across the entire supply chain. Smelting and mining environmental protection measures, such as wastewater, waste gas, waste residue treatment, and tailings and waste residue, are monitored 24/7. Environmental protection costs continue to rise as a percentage of total costs. This, combined with fixed costs such as human resources and labor insurance, supports price increases.

IV. Market Sentiment and Capital Gaming: Stockpiling and Speculation Amplify Fluctuations

Market sentiment and capital inflows amplify supply shortages, fueling speculation.

4.1 Stockpiling and Reluctance to Sell by Resources and Traders

In recent years, my country's tungsten ore resources have become increasingly concentrated, with control confined to a few leading companies. The perceived revaluation of strategic resources and the financing of large state-owned enterprises are driving this trend. Reduced difficulty and interest rates will lead to record low holding costs in 2025. Furthermore, the physical properties of tungsten resources allow them to be held for sale at extremely low cost. While controlling a large amount of resources, tightening supply chains and driving up prices rapidly can significantly increase the value of inventory at low or no cost, sufficient to achieve a strong finish to the 2025 annual report. Similarly, expectations of tight supply and price increases have fueled traders' expectations, leading to record-high stockpiles (some experts estimate that intermediate holdings in the supply chain are approximately 40,000 standard tons of tungsten concentrate, accounting for over 35% of the circulating supply). Another important factor is the market's anticipation of potential national stockpiling of tungsten, a crucial strategic resource. Putting aside all practical factors, the supply and demand balance in any industry chain is a simple principle: tight supply and high prices. The sole rationale for the surge in tungsten product prices is that mines and traders are holding back on stock, waiting for a higher price.

4.2 Financial Capital Influx

As mentioned above, tungsten resource mines and intermediaries are eager to buy at a high price, reflecting the fact that tungsten, as a key mineral and strategic metal, has attracted attention and participation from outside the industry chain. Speculative capital has not only invested in listed tungsten product companies, such as Xiamen Tungsten, Zhangyuan Tungsten, and China Tungsten High-Tech, whose share prices have hit new highs, but has also significantly boosted sentiment across the tungsten industry, with Anyuan Coal Industry, affiliated with Jiangxi Tungsten Group, also gaining popularity. Over the past few years, relevant futures institutions have been conducting in-depth research and testing on the inclusion of tungsten product futures, such as tungsten concentrate and APT, in the futures trading market. Analysts believe that relevant preparations are essentially complete. Will tungsten product futures take advantage of the rising tungsten prices? The entry of international tungsten into the market has become a significant factor in tungsten product market fluctuations.

V. Tungsten Industry Outlook: High-Level Fluctuations and Long-Term Uptrend

In the short term, tungsten prices may remain high and volatile (black tungsten concentrate at 200,000+ RMB/ton, tungsten powder at 450,000 RMB/ton). However, caution is warranted regarding periodic adjustments caused by profit-taking in midstream and production cuts by downstream cemented carbide companies due to cost inversion. In the long term, China Tungsten Online analysis believes that the annual increase in photovoltaic tungsten filament penetration, the continued expansion of demand from nuclear fusion, military and civilian large aircraft, and the continued peak of major infrastructure construction, coupled with resource scarcity, will steadily increase the central price of tungsten concentrate to 230,000-250,000 RMB/tbd.

5.1 Price Changes of Major Products in the Tungsten Industry Chain (August 15, 2025)

5.2 Analysis of Future Risks

Overseas Mine Expansion

For example, the Bakuta Tungsten Mine in Kazakhstan has commenced production, and Mount Carbide in Australia has commenced production. Mine (Carbine Mountain Mine) resumed production, and increased overseas supply may lead to a corresponding price correction.

Technological Substitution

The cost of cutting tools such as silicon carbide, alumina, and synthetic diamond is decreasing. New lithium battery technologies may also reduce the demand for tungsten additives. The emergence of alternative materials for photovoltaic tungsten filaments may also curb demand growth. Meanwhile, within the tungsten industry chain, major Western companies producing tungsten products, such as cemented carbide, are improving their waste recycling and smelting technologies. The cost and quality of recycled and virgin materials are converging, significantly increasing the proportion of recycled materials used.

Geopolitical Risk

The escalation of Sino-US trade frictions may further push up prices, but it may also lead Western countries to accelerate the development of alternative technologies, driving demand to South Korea, Australia, Southern Europe, Vietnam, Central Asia, and other regions. This may also lead Chinese tungsten companies to expand overseas. The resulting technology transfer and disguised exports may also partially erode the advantages of tungsten ore resources and their smelting and processing technologies. Russia's tungsten ore resources are also a factor influencing global tungsten product prices.

Economic Cycle

The global economic recession may dampen the application market for various tungsten products, and correspondingly, demand for military and new energy products will shift due to changes in national policies.

In short, the surge in tungsten prices in 2025 is the result of a complex interaction between shrinking supply, growing demand, policy adjustments, and market sentiment. Looking ahead, as a strategic resource, tungsten prices will remain high, but risk factors warrant attention. As industry practitioners, we recommend that companies strengthen supply chain management, increase R&D investment, and explore recycling technologies to cope with price fluctuations and industry upheaval.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com