Tungsten Market Stable, Awaiting Long-Term Contract Pricing Guidance

- Details

- Category: Tungsten's News

- Published on Tuesday, 06 May 2025 14:04

Analysis of Latest Tungsten Market from Chinatungsten Online

After the holidays, the tungsten market showed a high-level stalemate, and both buyers and sellers were temporarily in a strategic assessment period.

On the supply side, mining and smelting enterprises were affected by environmental supervision pressure, declining resource grades, and reduced mining indicators. The operating rate was low, and the raw material side had a strong willingness to support prices; on the demand side, the pace of downstream alloy factories and foreign traders slowed down, mainly digesting inventory, and actual transactions were dominated by scattered rigid orders. At present, the tungsten market is in a wait-and-see mood, and the core focus is on the long-term contract pricing of large tungsten enterprises and the adjustment of the guidance price of industry institutions. The transaction direction needs to wait for the signal of supply and demand game and policy changes. The cost side support is still significant. The high raw material prices have put pressure on the profits of the smelting link, forcing the downstream to accept high prices, but the poor transmission of terminal demand restricts the room for price increases.

The mainstream quotation of 65% black tungsten concentrate is RMB 151,000/ton, and the holders are obviously reluctant to sell, and it is difficult to find low-priced sources in the market.

The price of ammonium paratungstate (APT) was reported at RMB 221,000/ton. Smelters generally raised their quotations due to cost inversion, but high prices suppressed bulk purchases, and inquiries on the market were not active enough.

The price of tungsten powder was reported at RMB 330/kg, and the price of tungsten carbide powder was reported at RMB 325/kg. The price of cemented carbide products was raised to reflect costs. Downstream terminal purchases were replenished on demand. The demand in high-tech fields such as energy and military industry was expected to be relatively positive, but the trading in the mid- and low-end markets was sluggish.

The price of 70 ferrotungsten was reported at RMB 228,000/ton. The firm cost and supply chain risks pushed up the market. The special steel industry purchased cautiously, and the market transactions were mainly small-batch agreements.

The scrap tungsten market was temporarily stable, and the cost-effectiveness of recycled materials still existed, but the manufacturers' price support and the downstream price pressure formed a tug-of-war, and the market was cautious in circulation on demand.

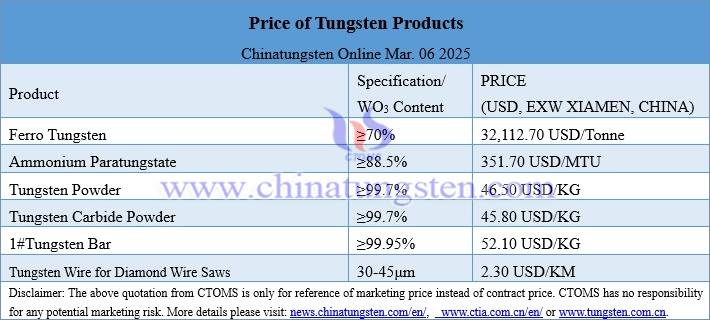

Prices of Tungsten Products on May 06, 2025

Picture of Tungsten Heating Element

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com