Tungsten Market: Demand Repairs Needed Amid Temporary Price Stability

- Details

- Category: Tungsten's News

- Published on Wednesday, 19 March 2025 15:36

Analysis of latest tungsten market from Chinatungsten Online

Tungsten prices generally remained stable, with marginal improvements in market supply-demand balance but still dominated by deadlock. External pressures from economic recession risks and geopolitical conflicts have kept traders cautious, resulting in subdued transaction activities and a wait-and-see stability in market dynamics.

65% wolframite concentrate prices remained at $19,718.3/ton. Recent inquiries from buyer for rigid demand saw slight increases, while suppliers maintained price stabilization measures. Spot transaction volumes remained unremarkable.

Ammonium Paratungstate (APT) prices hovered around $331.0/mtu, as industry chain stakeholders remained locked in a stalemate. No significant price fluctuations emerged in recent transactions, with market participants awaiting price updates from major enterprises' long-term contracts.

Tungsten powder prices were quoted around $43.9/kg, while tungsten carbide powder prices stagnated near $43.2/kg. Market trading sentiment was lackluster, with transactions primarily driven by immediate needs and participants adjusting strategies based on real-time conditions.

70% ferro tungsten prices temporarily stabilized near $30,422.5/ton. Market operators showed limited initiative, adopting a wait-and-see approach towards tungsten raw material cost fluctuations and steel procurement performance. Overall sentiment remained cautious and focused on maintaining stability.

The tungsten waste and scrap market maintained stable operations, though market participants held divergent views on price movements. Trading activities remained deadlock, with the market awaiting price signals from upstream sectors or recovery in terminal demand.

Macro data from January-February 2025 indicated moderate recovery in industrial and consumption sectors, providing certain support for tungsten demand. The 5.9% year-on-year growth in industrial added value reflected expansion in manufacturing activities, potentially driving demand for tungsten products such as cemented carbide and cutting tools. The 4% growth in total retail sales of consumer goods suggested gradual recovery in end-user consumption, indirectly benefiting marginal improvements in downstream applications like electronics and automobiles. The 4.1% growth in fixed asset investment indicated sustained expansion in infrastructure and manufacturing inputs, though flat private investment implied that private sector investment confidence still needed bolstering, which might constrain long-term tungsten demand growth. The unemployment rate remained stable at 5.3%, indicating a steady job market that helped maintain consumption and investment expectations, though its direct impact on the tungsten market was limited.

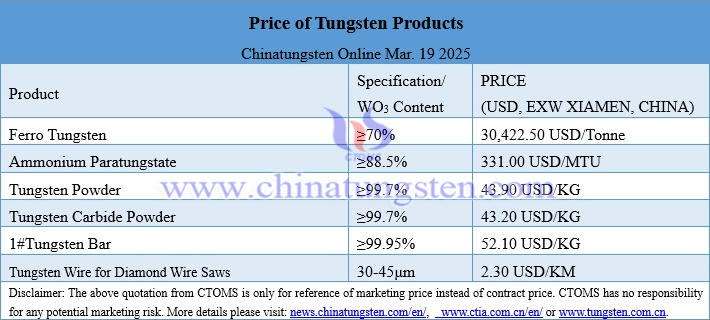

Prices of tungsten products on March 19, 2025

Picture of ferro tungsten

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com