Vietnam to Become Focus for New Rare Earths Supply

- Details

- Category: Tungsten's News

- Published on Monday, 03 April 2023 19:23

According to the U.S. Geological Survey (USGS), Vietnam is estimated to have the world's second largest mineable rare earth resource after China, with reserves of 22 million tons, compared to China's 44 million tons. North Korea holds the world's largest deposits, but sanctions have prevented the resource from being exploited in the global rare earths supply chain.

Despite years of exploration, Vietnam has so far failed to tap its potential. The country has mined just 400 tons of rare earths in 2021, down from 700 tons in 2020, dwarfing China's increase to 168,000 tons in 2021 from 140,000 tons in 2020, according to the U.S. Geological Survey. Japan turned to the country as a source of rare earth supplies in 2010 after a political dispute prompted China to limit exports to the country. Japan's trade statistics show the country is the second-largest exporter of rare-earth metals to Japan after China, but most of that is still Chinese material.

Japan is the world's second largest producer of rare earths containing permanent magnets after China, and Japanese companies have been investing in projects in the country for the past decade to secure non-Chinese materials. The drive to develop Vietnamese supplies stalled as trade between China and Japan normalized, but now there is renewed interest as the Japanese government has adopted a national security strategy that encourages companies to diversify their supply chains of key minerals.

Rare earths are a key raw material not only for electric vehicles and wind turbines - which are key to the clean energy transition - but also for electronics, medical applications and military equipment. More recently, other countries have begun to turn to the country to secure supplies by investing in development projects before they come out of the ground.

The country's economy is growing rapidly - 7.8pc in 2022, compared with 6.5pc this year, according to estimates by Fitch Solutions. And it is becoming an increasingly attractive regional base for companies dealing with U.S.-China trade tensions, supply chain diversification in the post-Covidien era and rising labor costs in China. Vietnam is becoming an important production base for electronic components and equipment in Southeast Asia, and is one of the fastest growing renewable energy markets. A number of countries are partnering with the Vietnamese government and private companies with a view to creating an integrated supply chain for rare earths and other key materials.

In early December, Vietnamese trade minister signed an agreement with his South Korean counterpart to cooperate in the exploration and development of core minerals, including rare earths, in Vietnam to provide a stable global supply chain. South Korean Trade, industry and energy minister Lee Chang-yang had proposed in August to strengthen cooperation in rare earths supply and sent an investigation team to explore ways to develop the sector.

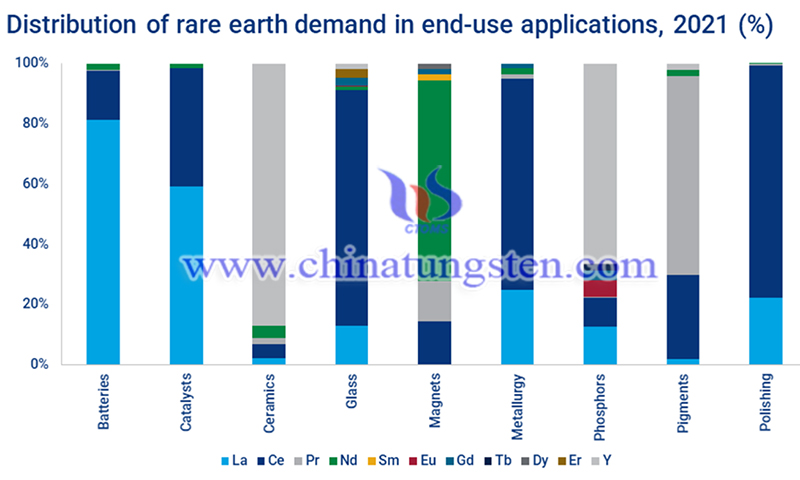

Distribution of rare earth demand in end-use applications in 2021

Australian companies are also exploring investments in Vietnamese mining sector, including Australian Strategic Minerals (ASM), which in mid-December signed a long-term agreement with Vietnam Rare Earths to supply rare earth oxides to its South Korean metals plant before ASM's Dubbo mine begins operations.

Under the Trans-Pacific Partnership Free Trade Agreement, Canada has increased trade with Vietnam, and in December, the Canadian province of Saskatchewan sent a delegation to the country to discuss additional opportunities. Saskatchewan's Minister of Trade and Exports noted the potential for cooperation between the two countries in green energy, including sustainable mining and rare earth elements.

Reference: https://www.argusmedia.com/en/news/2406483-vietnam-becomes-focus-for-new-rare-earths-supply

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com