Russia-Ukraine Conflict Magnifying US Concerns Over FeW Supply

- Details

- Category: Tungsten's News

- Published on Saturday, 12 March 2022 15:06

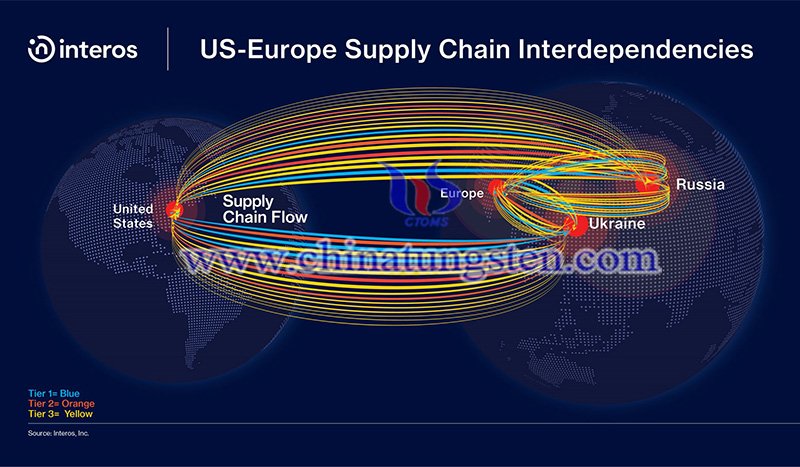

Russia's conflict over Ukraine has risen the US concerns about the ferrotungsten (FeW) supply base. Sanctions against Russian financial institutions and the suspension of major maritime suppliers have deprived Russia of the opportunity to export ferrotungsten to the U.S., market participants said.

Since 2020, only five countries have exported ferrotungsten to the United States. Russia, Ukraine, Austria, Vietnam, and South Korea. In recent years, Russia has been the main source and most frequent exporter of the alloy.

The logistical problems arising from the closure of terminals and the cessation of material transportation across the Sea of Azov and the Black Sea have made Ukraine cease to be one of the exporting countries as well.

According to the latest data provided by the US Commerce Department, Austria, Vietnam and South Korea have each exported ferrotungsten for only one month in the past two years.

Traders say Korean suppliers have offered fewer alloys to U.S. buyers in recent years, and there is currently little spot available. In Europe, where nearly 65% of Austria's alloy imports come from Russia, local producers may need to make up for the loss of supply in their own regional markets.

In addition to this, almost 50% of the alloys imported into the Netherlands are from Russia. Rotterdam in the Netherlands is considered to be the center of the European ferroalloy trade.

China is the main supplier until 2020, but tariffs imposed by former U.S. President Donald Trump have prompted sellers to source alloys elsewhere, and traders still say re-stocking from China is unrealistic. Since January 2019, the U.S. has stopped importing ferrotungsten alloys from China, mostly leaving Vietnam as the primary source to restock alloy unless buyers return to suppliers in China.

Meanwhile, U.S. imports of the alloy have steadily declined over the years, consistent with a trend toward reduced consumption of FeW by U.S. steelmakers, who use it primarily for machining, stamping, forging, cutting, and making tools.

International companies are also trying to comply with sweeping financial sanctions and export controls imposed by Europe, the United States, and a number of other countries that have clamped down on flows of goods and money in and out of Russia.

Traders are reluctant to commit to buying products with long lead times because by the time the alloy reaches the US ports, upward pressure on prices from the supply side may have waned. Conversely, if the military conflict becomes protracted, it could exacerbate uncertainty about investing in ferrotungsten. Some buyers are already replacing FeW with different forms of tungsten scrap in their melts, including density alloys.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com