Lithium Australia Refocuses on Battery Recycling

- Details

- Category: Tungsten's News

- Published on Friday, 24 July 2020 19:54

Lithium Australia NL ('LIT') said it will refocus operations on battery recycling and sales, cutting costs and jobs as it seeks to weather a slump in raw materials prices exacerbated by the coronavirus pandemic. The company is further reducing expenditures and providing the greatest support to the business units closest to positive cash flow to benefit shareholders. It said it would reduce the number of workers, but did not specify the number of layoffs.

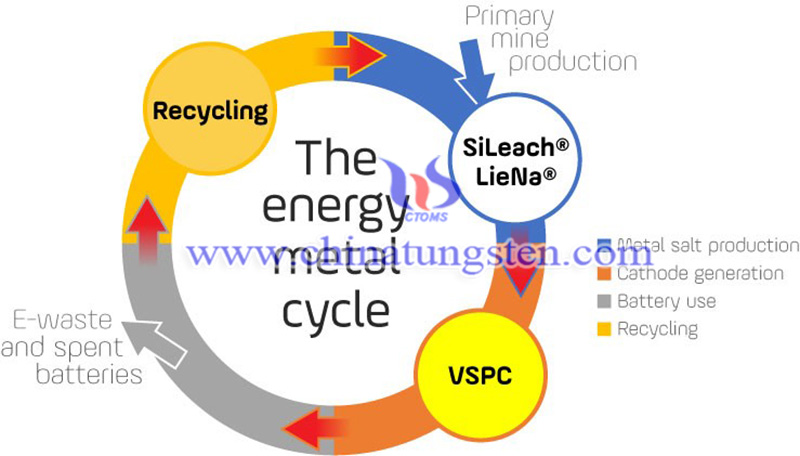

The Perth-based Lithium Australia NL aims to supply ethically and sustainably sourced materials to the battery industry worldwide. To that end, LIT has developed disruptive extraction technologies - including its proprietary SiLeach® process - and secured positions in lithium provinces around the globe, including Western Australia and Europe.

LIT takes the view that sustainability equates to viability concerning both the manufacture and disposal of lithium-ion batteries (LIBs), as well as battery recycling. Indeed, LIT believes discarded electronic/battery waste may ultimately prove the most cost-effective and environmentally friendly source of the so-called 'energy metals', among them lithium and cobalt.

The company is currently struggling to withstand the sharp drop in raw material prices aggravated by the new crown epidemic.

In a stock exchange filing, the Perth-based firm forecast "significant revenue" from its battery businesses in fiscal 2021, without disclosing exact numbers. With a market value of about $20 million, the firm reported an operating loss after income tax for the half December 2019 of just over A$3 million ($2.10 million).

Lithium Australia NL to refocus operations on battery recycling would help the company to weather a slump in raw materials prices. Despite a return of appetite for many commodities in the battery-minerals sector, the company said it expected lithium prices, which have been in a downward spiral for about two years on weak demand, to take much longer to recover.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com