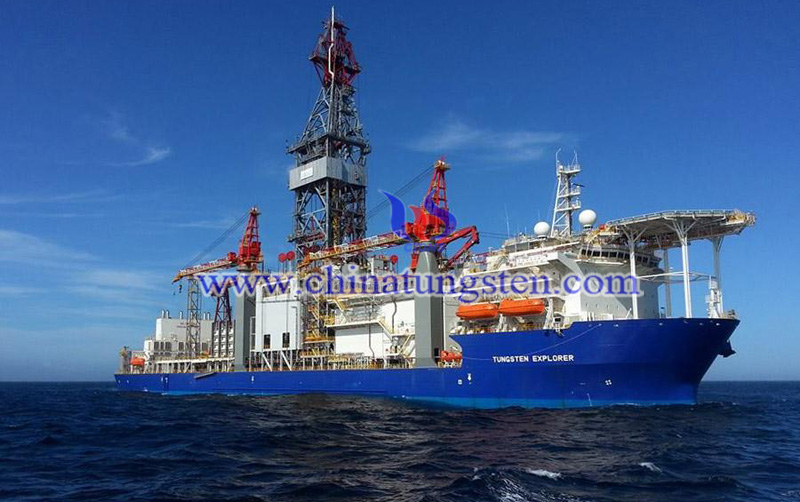

Tungsten Explorer to Drill ADES Offshore "Nigma 1" Well

- Details

- Category: Tungsten's News

- Published on Tuesday, 15 October 2019 19:19

The "Tungsten Explorer" drill ship provided by Vantage will be in service to drill "Nigma 1" well in Egypt. According to the Pipeline Oil and Gas Magazine on October 13, the US ADES International Holdings was awarded a deep-water well drilling contract in offshore Egypt.

China Tungsten Market Kept Firm with High Prices but Rare Deals

- Details

- Category: Tungsten's News

- Published on Monday, 14 October 2019 19:09

Analysis of latest tungsten market from Chinatungsten Online

The tungsten market in China kept firm in the week ended on Friday October 12, 2019 partly affected by the rise in new guide prices from institutions and listed tungsten companies. Sellers raised psychological prices of raw materials and were reluctant to sell products as they had certain profit margins. But considering rare deals concluded at high prices, insiders have mixed feeling about the outlook.

China Rare Earth Prices - Oct. 14, 2019

- Details

- Category: Tungsten's News

- Published on Monday, 14 October 2019 19:07

Rare earth market quotation in China: domestic rare earth prices continue to be weak in early this week. Recently, under the influence of relatively quiet news and the global manufacturing industry downturn, the market confidence is insufficient, and there is a certain resistance to the back-end demand order volume.

China Molybdenum Prices - October 14, 2019

- Details

- Category: Tungsten's News

- Published on Monday, 14 October 2019 19:05

China molybdenum prices are unchanged from the previous trading day as the market is still in a stalemate and insiders remain their cautious sentiment. in the molybdenum concentrate market, offers are in the chaos. Under the low inventories and weak ferro molybdenum market, supplies are different in their offers.

Russia's Polymetal May Invest in Rare Earth Project to Meet Electric Vehicle Demand

- Details

- Category: Tungsten's News

- Published on Monday, 14 October 2019 10:10

Russia's Polymetal will consider investing in the country's largest rare earth project Tomtor, which is being developed by the gold and silver producer's top shareholder. The chief executive of the company Vitaly Nesis said, according to the report of MOSCOW (Reuters).

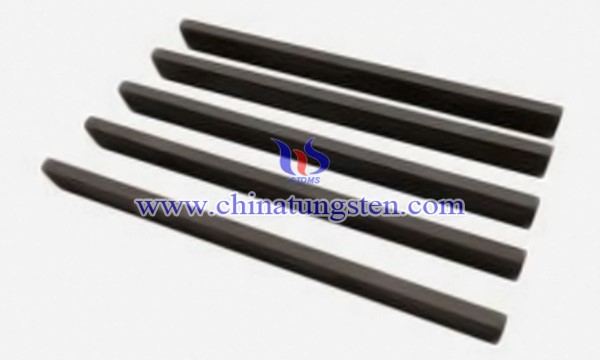

Tungsten Carbide Press Bars Enhances Vegetable Oil Production Efficiency

- Details

- Category: Tungsten's News

- Published on Monday, 14 October 2019 09:49

Tungsten carbide wear-resisting press bars are available and with the great physical and chemical performance that largely enhances vegetable oil production efficiency. Vegetable oil is the most important ingredient in our daily life. The oil press is the most critical equipment for the production of vegetable oil, and then squeeze bar is one of the main working parts of the oil press. To support the pressed material, improving the service life of the strip has become an urgent problem for the manufacturers of plants and presses.

Breakthroughs in Areas Like Rare Earth, Jiangxi Sets 12 Million Yuan for Technology Heroes

- Details

- Category: Tungsten's News

- Published on Monday, 14 October 2019 09:38

Jiangxi province has achieved breakthroughs in the areas such as development and application of high-performance rare earth and lithium-ion battery preparation and set a prize of 12 million yuan for rewarding technology heroes in core technologies.

China Cesium Tungsten Bronze Prices Are in the Upward Trend in Early October

- Details

- Category: Tungsten's News

- Published on Saturday, 12 October 2019 15:30

Analysis of latest tungsten market from Chinatungsten Online

The tungsten powder and cesium tungsten bronze prices in China continue to be in the upward trend because the rise in new guide prices from institutions and listed tungsten companies boosts market confidence. Sellers are generally reluctant to sell for higher prices. With the increase in profit margin and production resumed of mining enterprises, the spot resources increase, but actual deals still are limited due to weak demand.

China Rare Earth Prices - October 12, 2019

- Details

- Category: Tungsten's News

- Published on Saturday, 12 October 2019 15:28

China rare earth prices were in the downward trend in the week end on Friday October 11, 2019 mainly because of low trading activity and cautious sentiment of insiders. For light rare earth market, the supply increased after the return of the National Day holiday, but downstream buyers still has not high willingness in taking orders. The rise in listed prices of Northern Rare Earth boosted market confidence greatly.

China Ferro Molybdenum Price - October 12, 2019

- Details

- Category: Tungsten's News

- Published on Saturday, 12 October 2019 15:26

Molybdenum market quotation in China: ferro molybdenum price stabilized while prices of molybdenum concentrate, sodium molybdate and ammonium molybdate edged lower in the week ended on Friday October 11, 2019. Molybdenum raw material prices were weak as terminal users has limited consumption for them. Some of mining enterprises took the initiative to sell products, so the whole market trading increased.

sales@chinatungsten.com

sales@chinatungsten.com