China Tungsten Prices Remains at High Levels in Early December 2023

- Details

- Category: Tungsten's News

- Published on Monday, 11 December 2023 17:20

Analysis of latest tungsten market from Chinatungsten Online

China tungsten prices overall maintained high levels in the week ended on Friday, December 8, 2023, characterized by a standoff in the market. The optimistic sentiment arises from strong support at the mining end and the upward adjustment of quotes by institutions and large enterprises in the latest round.

However, spot transactions remain relatively subdued, with lackluster consumer performance. Bargaining sentiment among buyers remains unchanged, and market negotiations continue as participants predominantly focus on just-in-time transactions.

In the tungsten concentrate market, due to considerations of environmental safety costs and controlled resource quantities, suppliers maintain a generally strong pricing stance. Some have explored higher levels, reaching up to $17,571.4/ton. However, downstream users show limited acceptance of high-priced raw materials, resulting in continued stagnation in market transactions.

In the ammonium paratungstate (APT) market, the mainstream focus remains around $292.2/mtu. In contrast to the firm attitude on the tungsten raw material side, downstream bargaining sentiments persist. Trading within the market is not smooth, and smelting plants exhibit a cautious approach, with low enthusiasm for production and a focus on delivering long-term orders.

In the tungsten powder market, the pressure from accumulated inventory in the backend alloy market is yet to be alleviated. There is a lack of enthusiasm in purchasing raw materials, and new orders for powder market transactions are limited. Prices have followed the trend and approached around $38.9/kg. Actual trading confidence is under pressure, and there are notable differences in bargaining focuses within the market.

In the ferro tungsten market, influenced by the situation of the industrial chain's positive and negative sides, there is limited adjustment in the actual order focus, and the 70-grade ferro tungsten price hovers around $25,000.0/ton. Market participants are cautious, observing alloy and high-performance steel consumption.

In the scrap tungsten market, the relatively firm atmosphere on the cost side and the impact of limited consumption in the alloy sector lead to overall stable pricing from suppliers. However, the actual market shipment status remains in a standoff.

On the macro level, according to data from the General Administration of Customs, China's total import and export value in November was 3.7 trillion yuan, a year-on-year increase of 1.2%. Exports were 2.1 trillion yuan, up 1.7% year-on-year, while imports were 1.6 trillion yuan, up 0.6% year-on-year. From January to November, China's total import and export value was 37.96 trillion yuan, roughly the same as the same period last year. Exports were 21.6 trillion yuan, up 0.3% year-on-year, and imports were 16.36 trillion yuan, down 0.5% year-on-year. ASEAN, the EU, and the United States were China's top three trading partners, with total trade values of 5.8 trillion yuan, 5.03 trillion yuan, and 4.26 trillion yuan, respectively. They experienced changes of 0.1%, -2.2%, and -6.9%, respectively, year-on-year. China's imports and exports with countries participating in the "Belt and Road" initiative reached 17.65 trillion yuan, an increase of 2.6% year-on-year.

Prices of tungsten products on December 11, 2023

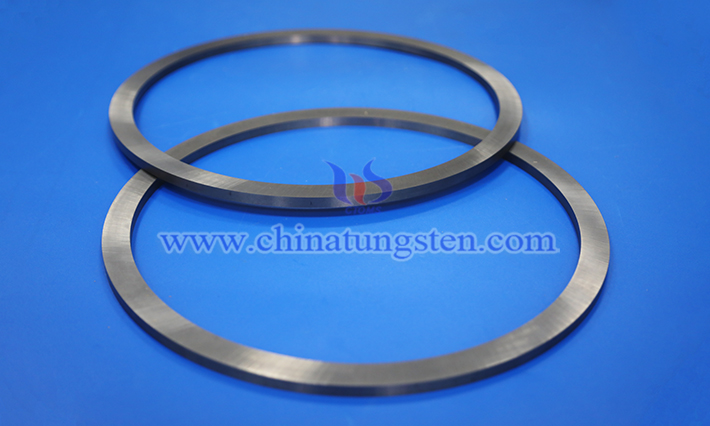

Picture of tungsten carbide rings

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com