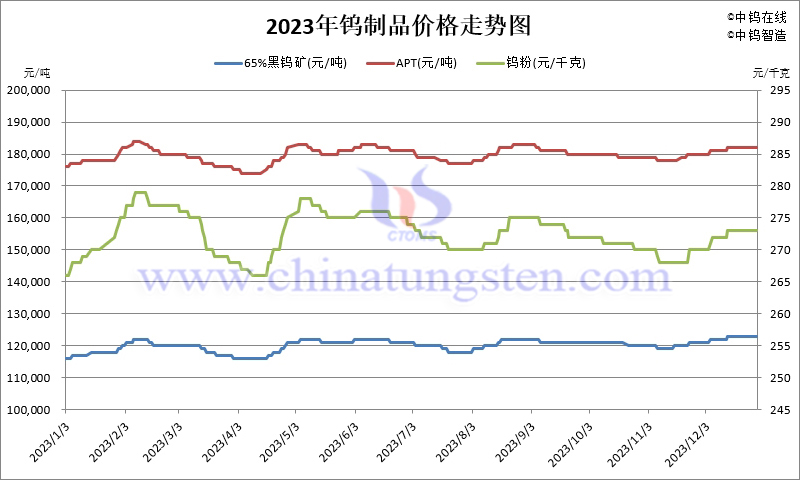

Overview of Tungsten Price in China, 2023

- Details

- Category: Tungsten's News

- Published on Wednesday, 03 January 2024 16:30

- Hits: 476

Tungsten Product Price Trends in 2023:

In 2023, as the first year of economic recovery after the transition phase of COVID-19 prevention and control, industry insiders and external observers had high expectations for the restoration of market economy and industry production and consumption.

This, to some extent, laid the foundation for the "initial rise" advantage in the tungsten market.

However, the complex world political and economic situation posed many challenges to the market. The reality of insufficient endogenous demand led to a shift in industry confidence. The consumption status of the tungsten market during the year did not meet expectations, and export data faced pressure on a year-on-year basis. The "sustained momentum" of tungsten product prices faced some resistance as the market continued to experience fluctuations.

Overall, the tungsten market in China in 2023 exhibited a trend of fluctuating upward, primarily driven by the pressure from the cost side and the robust support from the tungsten ore side. However, the momentum of demand still awaited improvement.

January:

With significant relief in COVID-19-related pressures and domestic measures to stabilize growth, industry expectations for the year's economic recovery and consumption revival were optimistic. This inspired positive sentiment in the tungsten market, coupled with reduced production due to maintenance cycles before and after the Spring Festival, limiting the release of market resources. The dominant mood was that suppliers hoped for rising prices, leading to stable and upward exploration of tungsten product prices.

February:

Production enterprises gradually resumed operations, but the consumption power of the tungsten market fell short of expectations. This led to an increase in bargaining atmosphere among spot traders, and the overall market sentiment slightly receded. However, positive signals from policy measures to stabilize the economy and promote consumption supported a clear stance on the part of tungsten raw material suppliers. Tungsten product prices experienced a limited pullback range, with spot transactions cautious and on-demand.

March:

After the Two Sessions, mining production operations further recovered, increasing the supply of tungsten market resources. However, the lack of clear positive release on the demand side, coupled with the impact of news such as the banking crisis overseas, further weakened consumer confidence. Tungsten product prices faced pressure, and March's export volume moved down by over 25%.

April:

The insufficient demand momentum in the tungsten market and pressure from the tightening monetary policies of major economies abroad continued to restrain market trading confidence. However, as environmental inspections were carried out in major production areas and downstream industries entered the market for periodic stockpiling, market activity increased slightly. The intention of tungsten raw material suppliers to raise prices intensified, and tungsten product prices showed a trend of decline followed by a rebound within the month, with a relatively dull trading atmosphere.

May:

The intensification of confidence differences across the industry chain led to a relatively loose attitude on the supply side of tungsten mines. However, confidence in tungsten chemicals and tungsten powder markets relatively loosened. Due to unclear downstream demand conditions and the uncertain international trade environment, the insufficient consumption power suppressed overall market negotiation focus. Tungsten product prices experienced a small decline before stabilizing in a horizontal range within the month.

June:

The contradiction between supply and demand in the tungsten market continued, with the impact of high temperatures suppressing the supply of some raw materials. The sluggish external demand situation remained unchanged, and the low economic vitality of the domestic economy, as reflected by data from downstream industries such as steel and excavators, affected the overall market trading atmosphere and negotiation focus. Tungsten product prices showed a trend of fluctuating consolidation in June, with a continued stagnant transaction status.

July:

The supply side of the tungsten market was relatively loose, but the demand side struggled to improve. The weak recovery of the domestic economy, influenced by pressure from overseas markets, dampened business confidence. External volatility and extreme weather events increased the economic upward resistance. Consumer entry sentiment remained low, and buyers delayed stockpiling. Smelters operated cautiously to hedge risks. Tungsten product prices operated under pressure.

August:

Positive information on the demand side of the tungsten market remained limited, and spot trading was lackluster. However, the reluctance of mining-side sales and the cautious low operating load of several smelters in locations like Ganzhou eased some basic pressure on the market. Suppliers followed with intentions to explore price increases, anticipating consumption release in the "Golden September and Silver October." Tungsten product prices showed a stable upward trend, and spot transactions remained cautious.

September:

The tungsten market's fundamental balance generally maintained a weak equilibrium. The mining side's attitude of holding back sales and the cautious low operating load of smelters contributed to a relatively controlled tungsten market resource volume. However, demand constraints remained unresolved. Before the Mid-Autumn Festival and National Day holidays, stocking conditions across various ends of the industry chain fell short of expectations. The absence of a "Golden September" consumption boost resulted in subdued actual transactions, leading to a languid state for tungsten product prices with weak consolidation.

October:

Unfavorable external conditions, including tightening monetary measures and escalating geopolitical conflicts, impacted the tungsten market's consumption-side recovery pace. The lackluster state during the traditional peak seasons of "Golden September and Silver October" pressured tungsten raw material prices. The stable market sentiment on the supply side and the operational reductions by several smelters in response to environmental inspections helped alleviate certain fundamental pressures. Suppliers maintained a watchful stance, and market transactions were sluggish, causing tungsten product prices to undergo weak consolidation.

November:

The tug-of-war situation continued in the tungsten market. The main negative factor was the insufficient driving force from the consumption side of the cemented carbide sector, while the main positive factor came from the steadfast attitude of tungsten mines. The difficulty of transferring cost and demand pressures from midstream smelters constrained the overall market. Spot transactions persisted in a sluggish state, and the market sentiment fluctuated with a slight rebound after initial suppression for tungsten product prices.

December:

Excessive supply pressure from the cemented carbide sector and resistance from downstream end-user consumption continued to suppress internal market transactions. Combined with the influence of holiday atmosphere, market transactions were quiet. However, the firm market attitude of tungsten mines and the requirement for year-end corporate reports provided support for the entire industry chain's market performance. Plans by some cutting tool companies to raise product prices further boosted market confidence. Tungsten product prices remained firm and closed the year on a resilient note.

In summary, the tungsten market in 2023 experienced fluctuations, influenced by global economic and geopolitical factors. While there were challenges and periods of weak demand, the tungsten market demonstrated resilience, with key support coming from the steadfast attitude of tungsten mines and occasional positive signals from downstream industries.

Follow our WeChat to know the latest tungsten molybdenum and rare earth prices, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com