China's Rare Earth Strategy: Technology Means More Than Raw Materials - 2/2

- Details

- Category: Tungsten's News

- Published on Thursday, 04 March 2021 17:22

- Written by Caodan

- Hits: 697

Bloomberg News quoted sources as saying that Chinese officials believe that China's rare earth processing technology has greater national interests than the resources themselves. Chinese media reported that the country’s capacity in separation and smelting is at the world's advanced level.

Figures show that after 2011, the number of patent applications for rare earths in China has increased rapidly, surpassing the total number of related patents in other countries in the world; between 2011 and 2018, the country's patent applications have increased by 250%.

However, David Fickling, a Bloomberg columnist, believes that if Beijing bans the export of rare-earth-refining technologies, the consequences will be more harmful than previous attempts to restrict trade in rare-earth mines.

After the start of the Sino-US trade war in 2019, the People's Daily issued an article stating that the Chinese would never agree to the United States using products made of rare earth elements (REEs) to curb development, and was prepared to restrict the export of REEs to the United States.

At that time, the British "Economist" magazine also believed that the country's rare earth card against the United States in the trade war would make the other countries realize the fragility of the supply so that they can make efforts to open up new supply channels and related technology innovations.

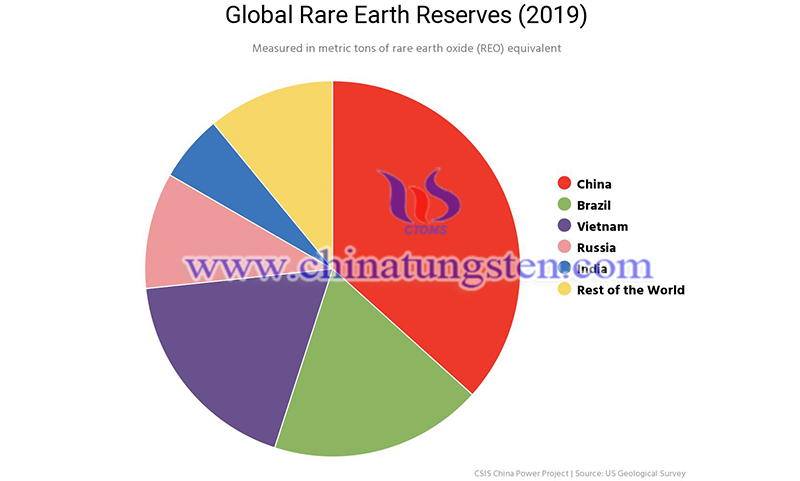

Lynas transports the rare-earth ore from Australia to their processing plant in the east coast of Malaysia for refining. According to 2015 data from the US Geological Survey, the world's rare-earth reserves are 130 million tons, and Chinese reserves are 55 million tons, ranking first in the world. Our country is the only country that can provide all 17 REEs.

Our country's 17 REEs exported in 2019 accounted for 85%-95% of the global market demand, and half of the raw materials of our country's exports came from Myanmar. In 2011, China began to raise the importance of the resources to the height of national strategy.

Japan and the U.S. take another path. To establish rare earth supply chain, Japan Oil, Gas and Metals Corporation (JOGMEC) has made a long-term investment in Australia's Lynas Company at a preferential interest rate. Lynas has become the only large-scale producer outside of China.

As China's domestic consumption of REEs grows, the country will be increasingly reliant on imports for the materials. Our country already became the world’s largest importer of REEs in 2018, and it is expected to become a net importer by the middle of the decade. Under these conditions, Beijing’s influence over the global rare earth industry would be reduced, and new players might finally find themselves able to compete. The development of processing technology is significantly important.

China's Rare Earth Strategy: Technology Means More Than Raw Materials - 1/2

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com