Rare Earth Market

- Details

- Category: Rare Earth News

- Published on Monday, 11 March 2013 15:56

- Hits: 1608

Exact statistics are difficult to come by in the rare earths field, partly because there is no official statistics agency, partly because they rely on Chinese sources where smuggling occurs, and partly because the end uses are so disparate. The Industrial Mineral Corporation of Australia (IMCOA) are widely respected and gave some updated numbers in a November 2012 presentation.

The anticipated rare earth supply for 2012 was estimated at 112,500 tonnes of rare earth oxide against production of 106,000 tonnes. Global production of heavy rare earths at 7,000 tonnes was 40% below the estimated 10,000 tonnes demand with almost all of this being produced in China. Global demand is expected to increase to 160,000 tonnes by 2016 and to 220,000 tonnes in 2020. Demand for heavy rare earths is expected to increase 45% but supply expected to remain static at 7,000 tonnes.

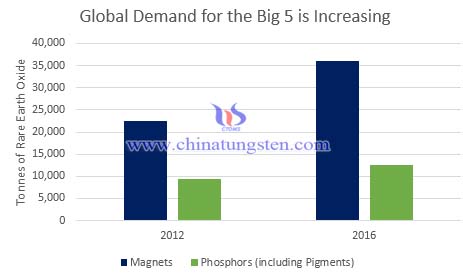

The five elements which drive the economics of rare earth production (what Frontier calls the “Big 5” are neodymium, praseodymium, dysprosium, terbium and europium. The two demand sectors which consume the majority of these elements’ production are magnets and phosphors. IMCOA sees demand for these increasing rapidly, which will help to support their prices while other elements – such as lanthanum and cerium – may be in oversupply.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com