The Current State and Strategy of the Tungsten Industry Under the Tariff Iron Curtain

- Details

- Category: Tungsten's News

- Published on Monday, 21 April 2025 17:28

- Hits: 304

China's tungsten industry holds a dominant position globally, with a tungsten output of approximately 65,000 tons in 2024, accounting for 85% of the global total (China Tungsten Industry Association, 2024). However, the industry faces shortcomings in high-end products and technology (high-end cutting tools account for only 20% of the market, China Machine Tool & Tool Builders' Association, 2024) and a low recycling rate (about 10%). Although there has been no explicit significant tariff increase on China’s critical minerals yet, starting in 2025, many Chinese industries will face challenges from the U.S. escalating tariff war (with U.S. tariffs on China reaching up to 245%), prompting a need to reassess strategic positioning.

Cemented carbides represent the primary form of the tungsten industry. This article attempts to analyze the insights from the current status of major global cemented carbide companies (Sandvik, Kennametal, Iscar, Mitsubishi Materials, Ceratizit) regarding raw materials, markets, recycling capabilities, and responses to tariff wars, thereby proposing strategic suggestions for China’s tungsten industry. The goal is to drive China’s transformation from a major tungsten resource country to a powerhouse in tungsten product manufacturing, processing, and recycling, ensuring its long-term position at the upstream of the industry chain and the forefront of green and intelligent manufacturing.

I. Analysis of Major Global Cemented Carbide and Tungsten Product Companies

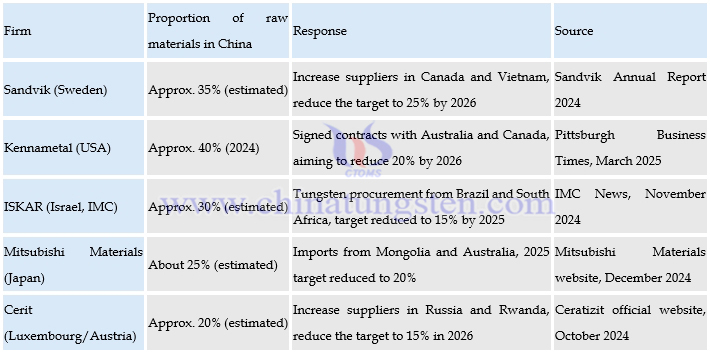

1.1 Dependence on Chinese Raw Materials

China accounts for approximately 85% of global tungsten ore production (International Tungsten Industry Association, 2024), making it a critical raw material source for the cemented carbide industry.

Kennametal and Sandvik: High dependence on Chinese tungsten raw materials (40% and 35%, respectively), significantly impacted by tariff measures, currently accelerating diversified supply chain development.

Ceratizit: Lower dependence (20%), more flexible through diversified procurement.

Global Trends: By 2026, the proportion of Chinese raw materials is estimated to decline by an average of 10%-15%, but short-term complete substitution remains difficult, underscoring the strategic value of China’s tungsten resources.

1.2 Dependence on the Chinese Market

China constitutes about 30% of the global cutting tool market (China Machine Tool & Tool Builders' Association, 2024), with aerospace and new energy demand growing by 15% annually.

Sandvik and Mitsubishi: Strong dependence on the Chinese market (15%-20%), but robust localized production in China allows moderate tariff mitigation.

Kennametal and Ceratizit: Lower dependence (10% and 8%), more easily able to shift to Southeast Asia and European markets.

Market Insight: With a market size of 60 billion yuan, prolonged tariff issues without significant improvement may drive foreign companies to accelerate local operations, threatening the market share of domestic firms.

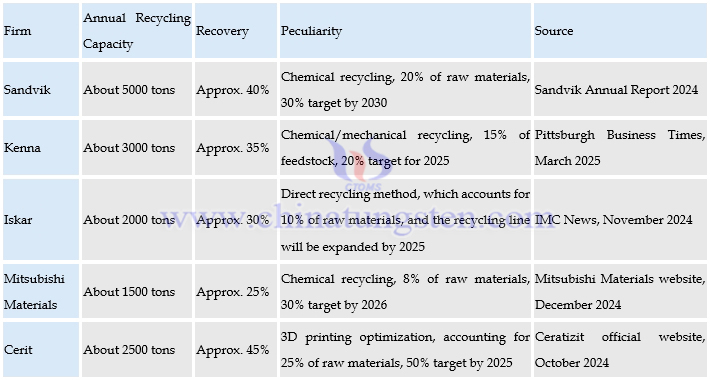

1.3 Tungsten Scrap Recycling Capacity and Recycling Rate

Global tungsten scrap recycling accounts for 30% of total supply (ITIA, 2024).

Ceratizit (45%) and Sandvik (40%): Lead in recycling rates, with technologies (e.g., 3D printing) reducing costs by 10%.

China: Recycling rate at only 10% (China Nonferrous Metals Industry Association, 2024), wasting approximately 5,000 tons of tungsten resources annually, highlighting a technological gap.

Cost Benefit: Higher recycling proportions lower raw material costs (recycling costs are 30% less than virgin ore), enhancing tariff resistance.

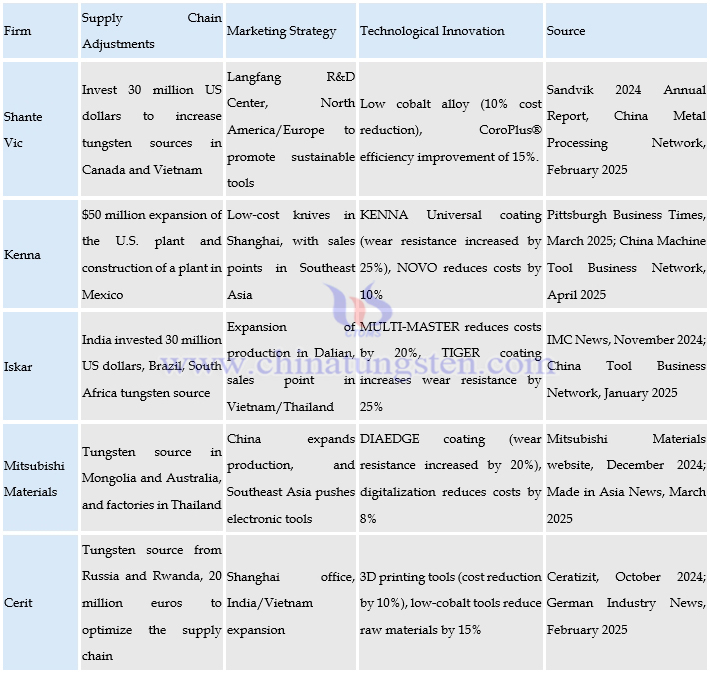

1.4 Measures to Cope with Tariff Issues

Kennametal and Iscar: Leverage layouts in Mexico and India to effectively avoid tariffs and respond quickly.

Sandvik: Deepens localization in China, pursuing a stable long-term strategy.

Mitsubishi and Ceratizit: Balance Asian and European markets, facing less short-term pressure.

Technological Innovation: Innovations like modular tools and 3D printing reduce costs by 10%-20%, forming the core of tariff war responses.

Key Insight: Experiences indicate that diversified supply chains, localized production, and high recycling rates are critical for risk mitigation.

II. Opportunities and Challenges for China’s Tungsten Industry

The analysis of global companies reveals the opportunities and challenges for China’s tungsten industry, establishing the foundational logic for its industry chain strategy.

2.1 Advantages and Challenges of China’s Tungsten Industry Chain

(1) Resource Advantage

China’s tungsten output accounts for 85% of the global total, with exports of approximately 15,000 tons in 2024 (China Customs Data, 2024), providing a stable foundation for the industry chain.

(2) Market Potential

China’s cutting tool market, valued at 60 billion yuan, grows at 15% annually, driven by strong demand in aerospace (C919 tool demand up 20%) and new energy (battery tool market at 20 billion yuan).

(3) Policy Support

Smart manufacturing, AI empowerment, carbon neutrality goals (2060), and the “14th Five-Year Plan” encourage high-end manufacturing and circular economy, offering opportunities for technological breakthroughs and recycling.

(4) Tariff Issue Dividends

Tariffs inflate costs for foreign imported products; foreign localization (e.g., Sandvik’s Langfang factory) brings technology spillover, allowing domestic firms to absorb advanced technologies through collaboration.

2.2 Challenges of China’s Tungsten Industry Chain

(1) Technological Shortcomings

High-end cutting tools account for only 20% of the market, with 40% import dependence; foreign technologies (e.g., Sandvik’s CoroPlus®) lead the field.

(2) Insufficient Recycling

A 10% recycling rate, far below Ceratizit’s 45%, results in an annual waste of 5,000 tons of tungsten resources, with costs 30% higher.

(3) Tariff Pressure

Tariffs of 145% and 125% may hinder exports, reducing tool usage and domestic production/sales; export profit margins may drop by 5%-10% (China Tungsten Online, April 2025 estimate), with intensified competition from Southeast Asia and Latin America.

(4) Geopolitical Risks

Technological barriers from Europe and the U.S. (e.g., EU’s 65% single-country import limit) compress export space, necessitating a global layout.

Summary

China should leverage its resource and market advantages, overcome technological bottlenecks, enhance recycling rates, optimize global positioning, and promote domestic cooperation and overseas acquisitions to secure its upstream position in the industry chain and transition into a powerhouse in resource production and recycling.

III. Strategic Thoughts on China’s Tungsten Industry

Based on the analysis, the following strategic suggestions aim to seize opportunities, address challenges, and position China as a long-term leader in the global tungsten industry.

3.1 Break Through Technological Bottlenecks and Capture the High-End Market

Profit Margin: High-end cutting tools yield 30% profit margins, far exceeding the 10% of low-end products. Compared to foreign technologies like Sandvik’s CoroPlus®, the gap is significant, necessitating accelerated innovation.

Policy Support: The government could offer higher R&D tax deductions (e.g., 30%) to encourage firms to invest 5% of revenue in R&D, promoting nano-grade tungsten powder, high-performance coated tools, AI-optimized processing, and high-end customization.

Collaboration: Companies like China Tungsten High-Tech (Zhuzhou Diamond) and Xiamen Tungsten (Xiamen Golden Egret) could partner with universities (Tsinghua, Central South, Xiamen) to develop low-cobalt alloys, reducing costs. Emulate Iscar’s modular tools with interchangeable heads to lower customer replacement costs.

Goal: By 2028-2030, increase high-end tool market share from 20% to 35%, boosting annual revenue by 20-25 billion yuan to meet aerospace (C919, C929, fifth- and sixth-generation aircraft, drones), low-altitude economy, and new energy (battery/automotive tools) demands.

3.2 Optimize Global Layout to Avoid Trade Barriers

Tariff Impact: Current tariff frictions may shrink export volumes and profits. Kennametal (Mexico factories) and Iscar (India expansion) demonstrate the value of overseas layouts.

Recommendations: Encourage Xiamen Tungsten and Zhuzhou Diamond to build factories in Vietnam and India for low-cost tools (estimated 15% price reduction), capturing overseas capacity and markets. Sign tungsten ore agreements with Brazil, Central Asia, and Mongolia to secure 10% of global raw material supply and primary smelting capacity. Explore Mexican assembly plants to leverage USMCA low tariffs for North America (25% of global tool market).

Government Incentives: Offer overseas acquisition rewards (e.g., 50% investment subsidies) and resource development support (e.g., low-interest loans) to acquire Australian/Canadian tungsten mines or European tool firms (e.g., small coating tech companies), linking with domestic chains like CATL’s European factories.

Benefits: Utilize low-cost regions (Vietnam labor 20-50% cheaper) and high-growth markets (Southeast Asia 10% annual growth) to boost export profits, raising Southeast Asian market share from 15% to 20% or higher, while enhancing local resource development and scrap recycling.

3.3 Promote Tungsten Scrap Recycling and Build a Green Supply Chain

Current State: China’s low recycling rate wastes 5,000 tons of tungsten annually, with costs 30% higher. Ceratizit (45%) and Sandvik (40%) succeed due to advanced tech and policy support.

Policy Context: Per the “Law on Prevention and Control of Environmental Pollution by Solid Waste” (2020 revision) and “Prohibited Import Solid Waste Catalogue” (Ministry of Ecology and Environment, 2020), tungsten scrap imports are restricted, with negligible volumes in 2024 against demand. Domestic scrap collection is only 20%, limiting circular use.

Suggestions:

(1) Relax Import Controls: Revise policies to allow tungsten scrap imports with a testing/emission regulatory system ensuring environmental compliance.

(2) Expand Domestic Recycling: Build centers in Hunan (Zhuzhou), Jiangxi (Ganzhou), Xiamen (Longyan), and Hebei, using zinc and chemical recovery methods to boost capacity, targeting a 30% recycling rate by 2028. Adopt 3D printing to reduce tool costs.

3.4 Increase Technological R&D Investment

Establish a national tungsten recycling lab with Central South University, developing electrochemical methods to raise recycling rates to 50%. Encourage firms to increase R&D as a revenue percentage.

3.5 Introduce Tax Incentive Policies

Reduce income tax for recycling firms, subsidize green equipment (e.g., waste recycling), and create a scrap collection network covering 80% of tool firms. A green supply chain aligns with carbon neutrality goals (2060), securing the industry chain’s upstream status.

3.6 Encourage Upstream and Downstream Industry Collaboration

Promote partnerships between aviation (COMAC), high-speed rail (CRRC), and local firms (Zhuzhou Diamond, Xiamen Tungsten) to develop customized composite tools (aviation) and rail processing tools, targeting 50% market share by 2027-2030. Expand mid-to-high-end capacity and develop low-cost tools for domestic SMEs and overseas mid-to-low-end markets.

3.7 Promote Intelligent Industry Construction

Encourage large tungsten firms and tech companies to build an industrial IoT, big data centers, and AI design/manufacturing hubs for the tungsten chain, advancing smart design (e.g., AI-designed high-entropy tungsten alloys) and intelligent manufacturing. Leverage China’s systemic and resource advantages.

3.8 Strengthen International and Regional Cooperation

Market Expansion: U.S. tariff wars and EU import limits compress exports. China’s industry should collaborate with Japan and South Korea on semiconductor high-end tools, boosting Asia’s high-end market share, and partner with European firms for complementary advantages, market expansion, and trade barrier avoidance.

Global Influence: Host national/international tungsten chain exhibitions and industry-academia-research conferences to foster exchange, aiming to lead the International Tungsten Industry Association (ITIA) and shape product/trade standards, enhancing global discourse power.

3.9 Establish an Industry Fund to Balance Market Supply and Demand

Local governments (e.g., Xiamen, Jiangxi, Hunan), industry firms, and financial entities (e.g., Shanghai Stock Exchange) should create a fund to regulate supply/demand, fulfill national reserve roles, and counter international industry/capital group control.

Conclusion

Through these strategies, China can secure long-term dominance over tungsten industry chain resources, capacity, markets, and operations.

IV. Conclusion

Major global cemented carbide companies employ diversified supply chains, localized production, and high recycling rates, exposing China’s tungsten industry chain weaknesses in technology, recycling, and global layout. China should focus on technological breakthroughs, recycling optimization, and global positioning, encouraging collaboration with local electronics, aviation, and rail firms, supporting overseas acquisitions and resource development, and ensuring a transition to a resource, production, and recycling powerhouse. Relaxing tungsten scrap import controls and advancing recycling technology will solidify its upstream position and lead the global tungsten industry.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com