Molybdenum Market - July 28, 2025

- Details

- Category: Tungsten's News

- Published on Monday, 28 July 2025 16:05

Molybdenum market update on July 28, 2025

At the beginning of the week, the domestic molybdenum market maintained a high-level sideways trend, with moderate trading activity and product prices fluctuating within a reasonable range.

This is due to strong reluctance to sell and bullish sentiment among molybdenum mining companies, contrasted by heavy price suppression from downstream users. Today, the prices of molybdenum concentrate, ferromolybdenum, and molybdenum powder are approximately 4,080 yuan per ton-unit, 265,000 yuan per ton, and 460 yuan per kilogram, respectively. Recently, steel companies such as Erzhong Equipment, Shougang Guigang, Nanjing Steel, Guangdong Shaogang, and China First Heavy Industry have tendered for ferromolybdenum, with tender prices around 259,000 yuan per ton. With difficulty in raising tender prices and accessing low-cost supplies, intermediate smelting companies face significant risks of cost-profit inversion.

In terms of news, according to the China Iron and Steel Association, in mid-July 2025, key statistical steel enterprises produced 21.41 million tons of crude steel, with an average daily output of 214.1 tons, an increase of 2.1% day-on-day; 19.44 million tons of pig iron, with an average daily output of 194.4 tons, an increase of 0.6% day-on-day; and 20.80 million tons of steel products, with an average daily output of 208.0 tons, an increase of 4.6% day-on-day. Based on this, it is estimated that the national daily output for this period was 2.76 million tons of crude steel, an increase of 2.1% day-on-day; 2.37 million tons of pig iron, an increase of 0.6% day-on-day; and 4.19 million tons of steel products, an increase of 2.3% day-on-day.

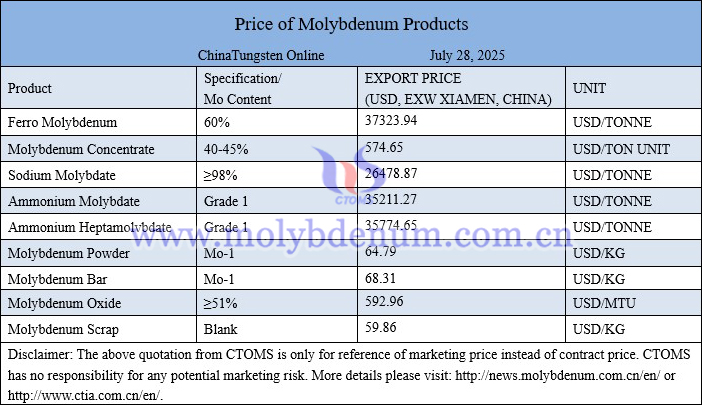

Price of molybdenum products on July 28, 2025

Molybdenum copper sheet picture

Follow our WeChat to know the latest tungsten price, information and market analysis.

| Molybdenum Supplier: Chinatungsten Online www.molybdenum.com.cn | Tel.: 86 592 5129595/5129696 Email:sales@chinatungsten.com |

| Tungsten News & Prices: Chinatungsten Online news.chinatungsten.com | Molybdenum News & Molybdenum Price: news.molybdenum.com.cn |

sales@chinatungsten.com

sales@chinatungsten.com