Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (III)

- Details

- Category: Tungsten's News

- Published on Thursday, 31 March 2022 11:51

- Hits: 1516

IMPACTS OF RUSSIA-UKRAINE CONFLICT ON TUNGSTEN MARKET & PRICE

PART III OF X

The Price Trend of Tungsten Under the Background of the Russia-Ukraine Conflict

In the PART I of this paper, we introduce all aspects of the military use of tungsten products as an important strategic material under the background of the conflict between Russia and Ukraine, and then clarify the importance of tungsten products under the situation of regional tension and cloudy war; In the second part, we use the tungsten resources of the former Soviet Union and Russia in recent years, the mining situation this year, the general situation of tungsten products processing industry and its main processing enterprises, and the import and export policies. At the same time, we summarize China's tungsten resources and its historical relationship with Russia's tungsten industry; Roughly describe the impact of the spillover effect of the conflict between Russia and Ukraine on the two aspects of tungsten products, that is, (1) Russia will strictly restrict its export of tungsten products to meet its military needs; (2) Russia may try its best to purchase tungsten products in the international market to meet the domestic demand for tungsten resources as raw materials and tungsten products as processing tools; (3) The Russian Ukrainian conflict is bound to accelerate the global consumption of tungsten products and urge countries to accelerate and increase the reserves of military equipment, weapons and ammunition. The demand for tungsten products in non-traditional fields will increase significantly, unless the Russian Ukrainian conflict is a serious contraction or continuous recession of the world economy.

Just as any war will bring drastic geopolitical changes and greatly change the production and life of local people, the real impact of the Russian Ukrainian conflict on the world and the impact on various commodity markets is also comprehensive and far-reaching, far from tungsten products; Factors such as supply interruption, material shortage, price rise and increased demand caused by war and conflict may also further raise the production cost and price of tungsten products.

Therefore, in the third part of this paper, we mainly analyze the future market trend and price of tungsten products from the perspective of inflation affecting the cost and price of tungsten products.

1. Basic Logic of Tungsten Price Rising in 2022

According to our analysis, under the current situation, the so-called price rise of tungsten products has three meanings:

(1) the price rise caused by supply shortage. As mentioned earlier, due to the increased demand for tungsten products caused by the Russian Ukrainian conflict itself and the temporary shortage caused by global supply, the rise of this nature may be after the Russian Ukrainian conflict eases and the strategic reserve and combat needs are met, the price of tungsten resources will return to a more normal level, which is determined by the normal market price mechanism;

(2) The continuous and irreversible rise in the price of tungsten products due to inflation caused by excessive currency in Europe, America and other countries has been seen with our own eyes since July 2021. Although it has decreased, it is really difficult to reverse or return to the past;

(3) The rise of market price caused by the direct and indirect production cost price rise of energy and power, auxiliary materials and human resources caused by inflation or supply shortage is the most real and irreversible, because it directly raises the profit and loss critical point of production enterprises. After such price rise, it will basically remain above the existing level, otherwise enterprises will stop production and sell at a low price.

First of all, among the above three factors affecting the price of tungsten products, the imbalance between supply and demand of tungsten products caused by the conflict between Russia and Ukraine is certain to increase demand in the short term, and what has happened and will be determined. Moreover, this increase in demand is rigid and does not make a rational choice based on the market price. Even if the price of tungsten products reaches or exceeds the historical high in a certain period of time, this kind of demand will not be greatly reduced due to the high price. This point has been preliminarily analyzed and expounded in the previous part of this paper.

Second, the inflation in the United States and affecting the whole world driven by the excess currency of the United States has occurred, and its follow-up effects and aftershocks will last for a long time, driving almost all price increases, thus promoting almost all factors in the production cost composition of tungsten products to rise and promoting their prices to rise simultaneously. In the third part of this paper, we will examine the impact on tungsten products from the perspective of inflation and price rise.

Third, according to the statistical data over the years and the geographical distribution of tungsten products, 80% of the world's tungsten products are produced and processed by China and provided to the world. Therefore, China's production and processing costs and prices can fully reflect the global price of tungsten products, and change its cost composition and price basis from the source side. Therefore, it is reasonable and logical for us to investigate the macro political and economic environment and the fluctuation of price components at the micro level in the supply and demand market relationship of China's tungsten products, and comprehensively consider the basic trend of tungsten product prices in 2022. We will demonstrate and explain this part in detail in the fourth part and subsequent contents of this paper.

2. Tight Commodity Supply Caused by the Russia-Ukraine Conflict

2.1 Resource and Industrial Advantages of Russia

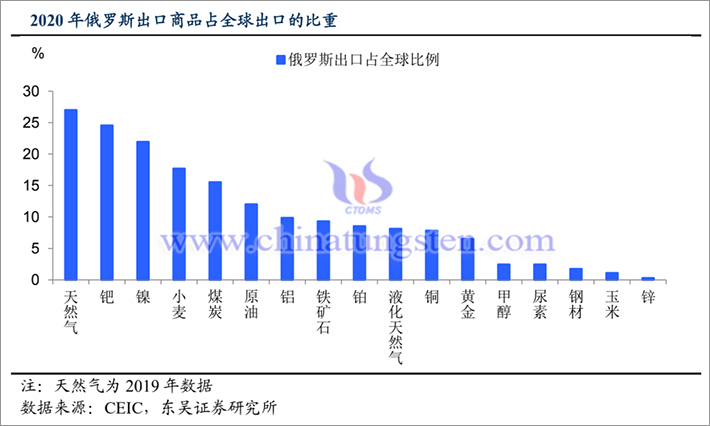

As the world's largest country, Russia spans Europe and Asia, faces the Americas across the Bering Strait in the northeast, and surrounds the Arctic in the north. The resource value of the vast land is naturally immeasurable. It can be seen only from the recent turmoil in the global commodity market. Russia is engaged in energy materials such as natural gas, oil and coal, metal resources such as steel, tungsten, rare earth, aluminum, copper, nickel and palladium, as well as wheat Corn, rapeseed and other food crops have strong resource strength and status that are difficult to be replaced in the world. Therefore, under the conflict between Russia and Ukraine, these commodities will undoubtedly be greatly impacted, and their prices will fluctuate sharply and rise sharply.

We should examine Russia's proven main resources and its world status with simple data as follows: the proven oil reserves are 6.5 billion tons, accounting for 12~13% of the world. Forest coverage area 8 6.7 billion hectares, accounting for 5.0% of the land area 7%, ranking first in the world, with a timber volume of 80.7 billion cubic meters. The proven reserves of natural gas are 48 trillion cubic meters, accounting for more than 1/3 of the world and ranking first in the world. Hydraulic resources 4270 cubic kilometers/year, ranking second in the world. Coal reserves are 200 billion tons, ranking second in the world. Aluminum reserves rank second in the world, iron reserves rank first in the world, uranium reserves rank seventh in the world, and gold reserves rank fourth to fifth in the world. China and Russia account for 55% of the world's total mineral exploitation, 28% of natural gas, 26% of diamond, 22% of nickel, 16% of potassium salt, 14% of iron ore, 13% of precious and rare metals, 12% of oil and 12% of coal. Russia is the world's major exporter of resources and the largest exporter of many resources.

Russia has inherited almost all the industrial characteristics of the former Soviet Union and has a strong industrial foundation. Except for a small number of former Soviet Union member countries such as Ukraine and Hasak, Russia has a sound industrial sector, mainly machinery, steel, metallurgy, oil, natural gas, coal, forest industry and chemical industry, and textile, food, wood and wood processing industries are also relatively developed; The main crops are wheat, barley, oats, corn, rice and beans; The main cash crops are flax, sunflower and sugar beet; Animal husbandry is mainly cattle, sheep and pigs.

The oil and gas exploitation and smelting industry is the largest main source of economic income in Russia. In addition to oil and gas exports accounting for almost 70-80% of the country's GDP, Russia's metallurgical industry is also very developed on the basis of rich metal resources. The reserves and output of iron, aluminum, copper, nickel, diamond and gold and silver rank among the top in the world. Its non-ferrous metal smelting capacity and technology are first-class, and the metallurgical industry accounts for about P3% of the country's GDP. Russia's military industry has the R & D, design and manufacturing capacity of various weapon systems of sea, land, air and space. Although its production and manufacturing capacity has declined in recent years, it is still the world's leading military power and the main weapon supplier of many countries in the world; Russia's aerospace industry is one of the earliest and most competitive industries in the world. Russia has complete aerospace industry planning and regulations, its own sounding station and return space shuttle, mature rocket engine and launch rocket system. According to its "2013-2020 Russian rocket and aerospace industry development plan", around 2020, The proportion of the aerospace industry in its domestic GDP will be increased to about 16%; Since the world's first nuclear power station built by Russia was put into operation in 1954, Russia has accumulated rich experience and technical reserves in uranium resource development, military and civilian utilization, miniaturization and diversification on the basis of its rich uranium resources and mature technology. Therefore, Russia has unique technical advantages in the field of and Industry.

2.2 Precious Metals and Non-ferrous Metals

2.2.1 Gold

2.2.2 Nickel

2.2.3 Copper

2.2.4 Aluminium and Zinc

2.3 Pressure of Russia-Ukraine Conflict on Global Eenergy Supply

2.3.1 Huge Impact of Russia-Ukraine Conflict on Energy Prices

2.3.2 Importance of Energy Price to China's Tungsten Industry

2.4 Rising Global Food and Edible Oil Prices

3. Currency Excess and Inflation in the United States

4. Inflation Factors Will be Superimposed to Push up China's Tungsten Price

From the above, we will come to the following conclusion about the supply shortage and price rise of basic commodities such as energy, metals and grain caused by the conflict between Russia and Ukraine, the increase of US dollar interest rate and the trend of RMB exchange rate: (1) The shortage of energy and food will be superimposed with the monetary sequelae caused by the epidemic, which will make the global prices rise continuously, which will eventually be reflected in the costs and prices of various industrial and agricultural products. The global inflation will eventually be quickly reflected in China, the only major producer of tungsten products, The production cost and price rise of various materials in China are also reflected in the cost of tungsten products, which leads to the continuous rise and maintenance of the price of tungsten products at a relatively high level. (2) On the other hand, due to China's comprehensive factors such as good epidemic control, good economic stability, positive and stable monetary policy and social security and stability, the RMB is generally optimistic and more and more popular. The recent sharp appreciation of the RMB relative to the strong US dollar is unprecedented, which will gradually increase the price of tungsten products priced in US dollars exported by China. (3) Even if the dispute between Russia and Ukraine will not cause inflation in China, the strong RMB will also hinder China's export industry, as will the tungsten products industry; At the same time, we must also realize that if the conflict between Russia and Ukraine continues to expand, it is bound to affect the process of global economic recovery, weaken the market demand and consumption prospect of tungsten products industry, and the price will also fall.

Looking at the current political and economic trends and the affordability and resilience of all parties in the game between sanctions and anti sanctions in Europe and the United States, we are optimistic that the conflict between Russia and Ukraine will not last for a long time; At the same time, in this situation, we boldly predict that:

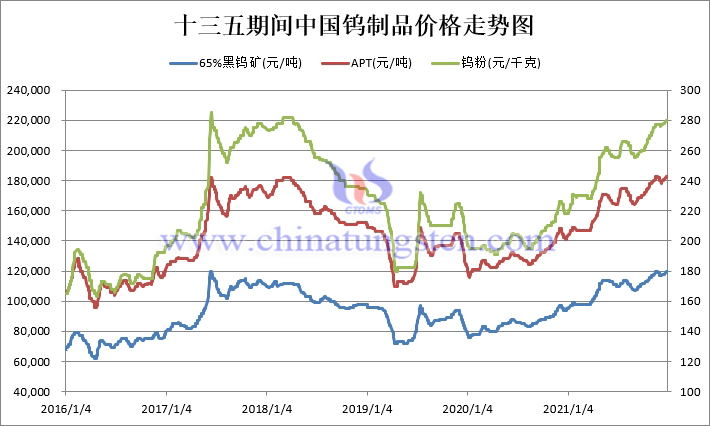

AFTER THE PRICE OF TUNGSTEN IN CHINA RISED 20% IN 2021, THE OVERALL AVERAGE PRICE OF TUNGSTEN WILL STILL RISE BY NO LESS THAN 20% IN 2022.

It's magical to see!

(THE REMAINING PART IV TO X WILL BE CONTINUED)

This article is published on the official account of WeChat on March 20022, and is also listed at www.ctia.com.cn and news.chinatungsten.com.

SUMMARY

Based on the experience of tungsten products market in the past decades and the current situation of the conflict between Russia and Ukraine, the author believes that the price of tungsten products will continue to rise in 2022, but the main factor is not traditional market factors; Therefore, in the first part, we focus on the Russian Ukrainian conflict and the military use and importance of tungsten products. In the second part, we focus on the global resource distribution of tungsten products, especially the overview of Russian tungsten resources and the relationship between China's tungsten products industry and Russia. In this part, we analyze the energy, bulk metals Factors such as the sharp rise in grain prices, the cost pressure on China's tungsten market caused by the over issuance of the US dollar and the US Federal Reserve's interest rate hike, and the possibility of a strong RMB. In the follow-up, we will analyze in detail the market trend of tungsten industry under the background of war and sanctions from the perspective of macro-economy and onlookers' processing costs, and comprehensively analyze the main factors and possibilities of the rise and fall of tungsten product prices in 2022; At the same time, we will also discuss the feasibility and risk of China's tungsten products futures; Since it is related to Russia, finally, we will briefly analyze the suspected fraud such as the so-called sky high price Russian tungsten gold bars that have appeared from time to time in the past few decades.

Read/download the full report:

'Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (III)'

'Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (II)'

'Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (I)'

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com