Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (II)

- Details

- Category: Tungsten's News

- Published on Wednesday, 30 March 2022 15:08

- Hits: 1180

IMPACTS OF RUSSIA-UKRAINE CONFLICT ON TUNGSTEN MARKET & PRICE

PART II OF X

Overview of Russia’s Tungsten Resources and the Relationship with China Tungsten Industry

When it comes to Russia, my first thought word is "vast territory and abundant resources". As the world's largest country, Russia has 17 million square kilometers of territory across Euro and Asia, facing the Americas across the Bering Strait in the northeast and the Arctic in the north. Although 60% of Russia's territory belongs to permafrost and more than 80 land is not suitable for human habitation, the resource value of its vast land is naturally immeasurable. It can be seen only from the recent turmoil in the global commodity market. Russia is rich in oil, natural gas, coal and other energy materials, steel, tungsten, rare earth, aluminum, copper, titanium, nickel, palladium and other metal resources, as well as wheat, corn Rapeseed and other food crops and special gas neon have strong resource strength and status that are difficult to be replaced in the world. Among these resources, tungsten, rare earth, titanium and palladium are important strategic resources. Various military struggles, political games, economic sanctions and anti sanctions around the conflict between Russia and Ukraine will be carried out around or inseparable from these resources and their decisive role.

1. Overview of Global Tungsten Resources

According to the report of China Tungsten online website, the global tungsten deposits are mainly distributed in the two metallogenic belts of the circum Pacific metallogenic belt and the Alps Himalayan metallogenic belt. The super large famous tungsten deposits distributed in the circum Pacific metallogenic belt include Zhuxi in Jiangxi, Dahutang in Jiangxi, Shizhuyuan in Hunan, Sisson and Northern dancer in Canada and NUI Phao in Vietnam, The total tungsten deposits in the circum Pacific metallogenic belt account for more than 1/2 of the total tungsten deposits in the world. The alpine Himalayan metallogenic belt is distributed with large and super large tungsten deposits such as verkhne kayrakty in Russia, hemer don in Britain, mittersill in Austria and barruecopardo in Spain. The world's tungsten deposits are mainly quartz vein type, porphyry type and skarn type. The skarn type tungsten deposit is the most important tungsten deposit in the world, and its reserves account for 1/2 of the world's total reserves.

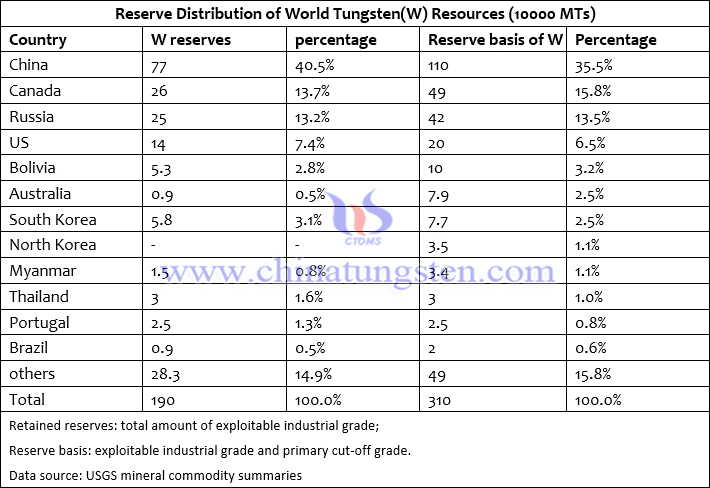

The total reserves of tungsten resources in the world are estimated to be 7 million tons, of which about 30% are wolframite and 70% are scheelite. The world's tungsten resources are mainly concentrated in China, Canada, Russia, the United States and Bolivia, accounting for 87% of the world's total reserves. Other countries include Kazakhstan, Australia, Thailand, Portugal, Brazil, Myanmar, Austria, North Korea, Uzbekistan, Vietnam, etc. China is the country with the richest tungsten resources in the world, with reserves of 1.9 million tons and reserves base of 4.2 million tons, accounting for 68% of the world's tungsten resources. Russia has tungsten reserves of 400,000 tons, accounting for about 10.81%, second only to China; The total reserves of tungsten resources in Canada are 260,000 tons (tungsten content). If calculated on the basis of reserves, it is 490,000 tons. It ranks third in the world, accounting for about 8% of the world's tungsten resources. Canadian tungsten deposits are mainly concentrated in the Selwyn tungsten belt, and the most commercially valuable deposits occur in the extension zone from the Cassiar batholith in British Columbia to the Macmillan deposit on the border between the Yukon and the northwest. Followed by Russia, whose tungsten resources account for about 6.8% of the world's tungsten resources.

There are 21 provinces, autonomous regions and municipalities directly under the central government with proven tungsten reserves in China. Among them, there are 8 provinces and regions with reserves of more than 200,000 tons, which are Hunan 1,798,900 tons, Jiangxi 1,100,900 tons, Henan 628,500 tons, Guangxi 349200 tons, Fujian 306,700 tons, Guangdong 230,200 tons, Gansu 222,900 tons and Yunnan 216,600 tons, accounting for 91.7% of the national tungsten reserves (according to the statistics of the national tungsten reserves at the end of 1996). From the distribution of China's major administrative regions, the central and southern regions account for 58.2% of China's tungsten reserves, ranking first, followed by East China, 28%, northwest, 4.3%, southwest, 4.1%, northeast, 3.2% and North China, 2.2%. The proportion of tungsten reserves distribution in the three major economic regions: the eastern coastal region accounts for 17.1%, the central region accounts for 75.1%, and the western region accounts for 7.8%.

Tungsten deposits in China are mainly distributed in five metallogenic belts: Sanjiang tungsten tin metallogenic belt, West Qinling Qilian Mountain metallogenic belt, Tianshan Beishan metallogenic belt, South China metallogenic belt and North China metallogenic belt. Among them, Nanling metallogenic area in South China metallogenic belt is the most intensive. Many large and super large tungsten deposits are distributed in this metallogenic belt, accounting for more than 70% of the national reserves, and China's tungsten reserves remain at 1.8-1.9 million tons. In 2014, the global tungsten reserves were 3.3 million tons, of which China accounted for 1.9 million tons, accounting for nearly 60% of the world. In 2013, China identified 7.014 million tons of tungsten reserves. There are 21 provinces, autonomous regions and municipalities directly under the central government with proven tungsten reserves in China, which are 1.8 million tons in Hunan, 1.1 million tons in Jiangxi, 630,000 tons in Henan, 350,000 tons in Guangxi, 310,000 tons in Fujian, 230,000 tons in Guangdong, 220,000 tons in Gansu and 220,000 tons in Yunnan. In terms of the distribution of major administrative regions in China, the central and southern regions account for 58.2% of China's tungsten reserves, 28% in East China, 4.3% in Northwest China, 4.1% in Southwest China, 3.2% in Northeast China and 2.2% in North China. In terms of the distribution of tungsten reserves in the three major economic regions, it is mainly concentrated in the central region, accounting for 75.1%, and the eastern coastal and western regions account for about 17.1% and 7.8%.

In recent years, China has increased investment in tungsten exploration, with an average annual investment of about 300 million yuan. Large tungsten mines such as Dahutang and Zhuxi have been found one after another. In 2014, a new large porphyry tungsten mine was found in Hunan. From 2006 to 2013, China's proven tungsten resource reserves increased from 5.584 million tons to 7.014 million tons, with a cumulative increase of 1.43 million tons, with an average annual growth rate of 3.7%. From 2006 to 2013, China's newly identified tungsten resource reserves were 2,428,400 tons, with an average annual increase of 303,600 tons. In particular, the discovery of Jiangxi Dahutang super large tungsten mine in 2012 made the newly identified tungsten resource reserves reach a record high of 1,016,000 tons in 2012.

In China, wolframite was mainly discovered and exploited in the early stage, with less scheelite. However, China's tungsten reserves are dominated by scheelite and less wolframite. By the end of 1996, tungsten reserves were 5.2908 million tons, of which scheelite accounted for 71.1%, wolframite accounted for 26.4% and mixed tungsten ore accounted for 2.5%. For a long time, although wolframite reserves are small, it is rich and easy to mine and beneficiate, accounting for more than 90% of the output of tungsten concentrate; Scheelite has large reserves, less rich ore and low grade, accounting for only about 10% of the output of tungsten ore; In recent years, with the improvement of mining and beneficiation technology, the utilization rate of scheelite is higher and higher. In order to adapt to the characteristics of Scheelite Concentrate, many enterprises have developed relevant mining, beneficiation and smelting technology and equipment to improve the recovery rate and reduce the production cost.

During their visit to Ganzhou Grand Tungsten Industry Co., Ltd., an upstream supplier, in mid March, China Tungsten online specially visited the company's new apt production plant with an investment of hundreds of millions of yuan. The plant uses mature smelting technology and can use black and white tungsten concentrates at the same time to taste high-quality ammonium tungstate products on the basis of high recovery rate, it is believed that the operation and successful operation of the plant will become another important new force in China's tungsten smelting industry.

For many years, China has been the world's largest country of tungsten resource reserves, exporters and consumers. For many years, China has almost always been a net exporter of tungsten products, so it has hardly imported tungsten raw materials from Russia. Therefore, the author optimistically estimates that the escalation of the conflict between Russia and Ukraine will not have a direct impact on the supply and demand relationship of tungsten products market in China, However, the supply gap in overseas markets may be further highlighted with the geopolitical tension of the conflict between Russia and Ukraine, which will promote the rise of global tungsten prices, and part of the import demand originally relying on Russian tungsten resources will also be transferred to China.

With the improvement of the awareness of the scarcity and importance of strategic resources and the strict control of environmental protection and production safety requirements, China's tungsten resources have also bid farewell to the era of "cabbage price". After the price of various tungsten products rises in the process of global economic recovery in 2021, it will remain at a relatively high level and it is difficult to decline significantly.

2. Overview of Tungsten Resources in Russia

Russia is not only the country with the largest land area in the world, but also one of the countries with rich mineral resources in the world. Russia's non-ferrous metals such as titanium, zinc, cobalt, tin, antimony, lead, mercury and other resources account for 37% of the world's mineral resources. In the country's mineral base structure, black and non-ferrous metals account for 13%, non-metallic mineral raw materials account for 15%, and diamonds and precious metals account for 1%.

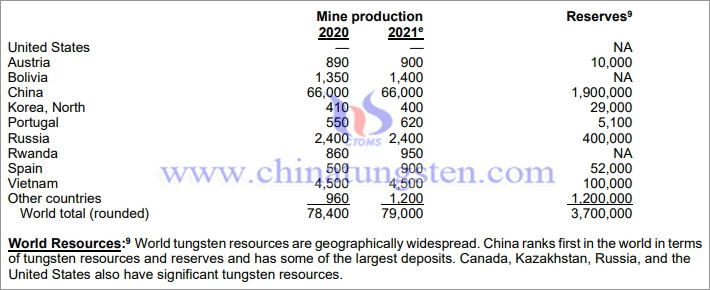

Russia is the second largest tungsten resource reserve country and the third largest tungsten producer in the world. Its tungsten resources are mainly concentrated in the north Caucasus, East Siberia and the middle of the sikhote Alin mountains in the Far East. The larger mines are verkhne kayrakty. According to the data of the U.S. Geological Survey, Russia's tungsten production in 2021 was 2400 tons, the same as that in 2020, accounting for 3% of the total global tungsten production. Of course, in terms of reserves, China has the largest tungsten reserves in the world, with a total reserve of 1.9 million tons, while Russia, a large resource country, has only 250000 tons of tungsten reserves, and China's tungsten reserves are almost eight times that of Russia. Russia is a major military power in the world. Tungsten resources with high military value and strategic use are of great significance to the country and even the world.

In addition to tungsten resources, Russia is also one of the countries with rich molybdenum resources. In 2021, Russia's Molybdenum output was 2800 tons, an increase of 100 tons over 2020, accounting for 0.9% of the total global molybdenum output; Russia's rare earth minerals mainly include titanium niobate, apatite and fluorocarbonate. In 2021, Russia's rare earth output was 2700 tons, the same as that in 2020, accounting for 1% of the total global rare earth output; Russia is also the country with the largest palladium reserves and supply in the world, accounting for about 46% of the total palladium reserves in the world.

2.1 Russia's Far East Tungsten Reserves Rank First in Russia

2.2 Overview of Major Tungsten Mining & Development Enterprises in Russia

2.3 Primorsky Tungsten Mine in Russia and its Difficulties

2.4 Lemontov Tungsten Mine

2.5 Export Tariff of Russian Tungsten Ore and Concentrate

3. Major Tungsten Enterprises in Russia

4. Relationship Between Chinese Tungsten Industry and Russia

4.1 Brief History of China's Tungsten Industry

4.2 China's Tungsten Industry Aided by the Soviet Union

4.3 Zhuzhou Cemented Carbide Plant(also named 601 Plant)

4.4 Zigong Cemented Carbide Plant (also named 764 Factory)

4.5 Xihuashan, Dajishan & Kuimeishan are all Tungsten Mines in Jiangxi, China

4.6 Historical Relationship between China and Russia Tungsten Industry

......

Therefore, we say that the tungsten industry of China and Russia has a deep origin. Russia once played an important role in the development of China's tungsten industry. Our tungsten industry has been deeply branded by Russia in the decades after the 1950s. Today, China's tungsten products industry is no longer the same as Russia in terms of resources, technology, product quality and industrial chain scale.

The development of Russian tungsten products industry will play an important role in the current conflict between Russia and Ukraine, and have a great impact on the global supply and market of tungsten products. Our view is that: (1) the tension of the military situation will make countries around the world step up the production and reserve of relevant strategic materials, and take the principle of giving priority to self-protection. Therefore, we believe that the supply of tungsten resources will continue to be relatively tight in the next few years. From the perspective of supply and demand, the price without resources will maintain a stable rising pattern; (2)Even if the dispute between Russia and Ukraine will not cause substantial inflation in China in a short time, resulting in a sharp rise in the production cost and high price of tungsten products, the stable and strong Chinese currency will also lead to a rise in the price of tungsten products mainly originating from China due to the currency price; (3) As Russia's demand for tungsten resources is bound to increase significantly due to the war, it also urges Russia not only to restrict the export of its own tungsten products, but also to try to purchase as many tungsten resources as possible in the international market to supplement its war consumption and enhance the reserve of such strategic materials, which will produce a certain degree of tungsten product demand depression and absorb corresponding tungsten resources to a certain extent; (4) Of course, at the same time, we must also be aware that if the conflict between Russia and Ukraine continues to expand, it will inevitably affect the process of global economic recovery, weaken the market demand and consumption prospect of tungsten products industry, and the price of tungsten products will inevitably fall.

For more information about the history, current situation and future development trend of China's tungsten industry, news, products, prices and market dynamics, please visit our website www.ctia.com.cn

SUMMARY

Based on the experience of tungsten products market in the past decades and the current situation of the conflict between Russia and Ukraine, the author believes that the price of tungsten products will continue to rise in 2022, but the main factor is not traditional market factors; Therefore, in the first part, we focus on the conflict between Russia and Ukraine and the military use and importance of tungsten products. In this part, we introduce the global resource distribution of tungsten products, especially the overview of Russian tungsten resources and the relationship between China's tungsten products industry and Russia. In the later part, we will start from the intensification of tungsten market cost pressure under the background of resource struggle under the conflict between Russia and Ukraine from the perspective of currency and finance, analyze the market trend of tungsten industry under the background of war and sanctions, and comprehensively analyze the main factors and possibilities of the rise and fall of tungsten product prices in 2022. At the same time, we will also discuss the feasibility and risks of China's Tungsten product futures.

(THE REMAINING PART III TO X WILL BE CONTINUED)

This article is published on the official account of WeChat on March 20022, and is also listed at www.ctia.com.cn and news.chinatungsten.com.

Read/download the full report:

'Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (II)'

'Impacts of Russia-Ukraine Conflict on Tungsten Market & Price (I)'

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com