China’s Control of Rare Earths Leads to Factories’ Import from US and Myanmar

- Details

- Category: Tungsten's News

- Published on Saturday, 07 November 2020 15:50

- Written by Caodan

- Hits: 771

China's restrictions on rare earths production lead to factories’ import from the US and Myanmar. Our country is currently the world’s largest producer of rare earths. However, industry insiders revealed that the production limits, enforced to limit environmental damage from rare earth mines and keep prices high, are forcing Chinese manufacturers that depend on rare earths for a range of industrial applications to turn to overseas suppliers, triggering a surge of imports from the US and Myanmar.

The Financial Times reported that China’s largest rare earth producer - Northern Rare Earth, an unnamed executive interviewed, said that production quotas not only affected the company’s finances but also reduce the stability of supply. Even though Northern Rare Earth has an oligopoly in some rare earth elements, its profit rate is lower than that of overseas competitors.

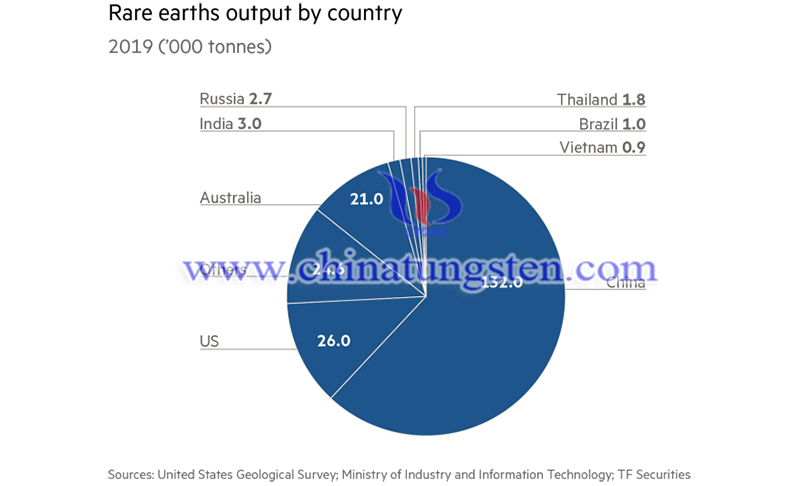

Last year, more than 60% of the global rare earths were produced in China, and the United States was the second largest producer, accounting for 12%. However, official data shows that China's rare earth imports in the first half of this year have surged 74% compared to the same period last year. Rare earth consumers such as smelters and magnet merchants are now rushing to place orders overseas.

The rapid recovery of the Chinese economy since the epidemic has made rare earth supplies even more scarce. An executive said that Chinese output of electric vehicles in the third quarter increased by as much as 32% annually, which is one of the reasons for the surge in domestic rare earth demand.

A report issued by Baotou City in Inner Mongolia last year showed that the local magnet factory had less than 50% capacity utilization due to rare earth shortages. This has led many Chinese companies to turn to Mountain Pass Materials, the only rare earth miner in the US, and Myanmar suppliers to purchase rare earths, which accounted for 38% and 30% of Chinese rare earth imports last year. The main control of the Mountain Pass mine is in the hands of American investors, but 10% of the equity is sold to a Chinese company, and all rare earth output is sent to China for processing.

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com