ALJ Bullock terminates investigation in Certain Sintered Rare Earth Magnets

- Details

- Category: Rare Earth News

- Published on Friday, 01 February 2013 16:47

- Hits: 2844

ALJ Charles E. Bullock issued the public version of Order No. 44 (dated January 8, 2013) in Certain Sintered Rare Earth Magnets, Methods of Making Same and Products Containing Same (Inv. No. 337-TA-855).

According to the Order, ALJ Bullock granted a motion filed by Complainants Hitachi Metals, Ltd. and Hitachi Metals North Carolina, Ltd. (collectively, “Hitachi Metals”) to terminate the investigation based on withdrawal of the complaint as to Respondents TELEX Communications, Inc. (“TELEX”) and Electro-Voice, Inc. (“Electro-Voice”).

According to the Order, ALJ Bullock granted a motion filed by Complainants Hitachi Metals, Ltd. and Hitachi Metals North Carolina, Ltd. (collectively, “Hitachi Metals”) to terminate the investigation based on withdrawal of the complaint as to Respondents TELEX Communications, Inc. (“TELEX”) and Electro-Voice, Inc. (“Electro-Voice”).

The motion was based on Bosch Security Systems, Inc’s (“Bosch”) assertion that TELEX and Electro-Voice are not separate corporate entities independent of Bosch. The Commission Investigative Staff supported the motion. Accordingly, ALJ Bullock granted the motion and terminated the investigation as to TELEX and Electro-Voice.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Ucore Sets Sights on 2016 Production Start for Alaskan Rare Earth Project

- Details

- Category: Rare Earth News

- Published on Friday, 01 February 2013 16:33

- Hits: 2829

Ucore Rare Metals, a junior explorer looking for rare earth deposits in North America, is aiming to commence production at its Bokan project in Alaska by 2016.

Citing a Ketchikan Daily News article, Metal-Pages reported that Ucore, which is focused primarily on its Bokan-Dotson Ridge rare earth element (REE) property, plans to commence construction of the mine by 2014, contingent upon obtaining the necessary permits, before beginning operation two years later.

Citing a Ketchikan Daily News article, Metal-Pages reported that Ucore, which is focused primarily on its Bokan-Dotson Ridge rare earth element (REE) property, plans to commence construction of the mine by 2014, contingent upon obtaining the necessary permits, before beginning operation two years later.

In November 2012, Ucore released a preliminary economic assessment (PEA) for the project. It shows a before-tax net present value of $577 million and an internal rate of return of 43 percent — impressive economics in a struggling market environment.

In July of last year, the company’s CEO, Jim McKenzie, told Rare Earth Investing News that Bokan Mountain is the largest NI 43-101 compliant heavy REE resource on United States soil; as a result, it has enormous strategic implications for the US, especially given that heavy REEs are the backbone of some of the technologies that are most important to the country’s economic future (for instance, transportation, clean energy, defense systems and medical science).

He added that the project could help challenge China’s domination of the market.

“We view the rare-earth space as a sort of race … Obviously China is withdrawing product from international markets fairly aggressively, and the US needs this product,” Metal-Pages quoted McKenzie as saying.

The Bokan property is enriched with heavy REEs, including dysprosium, terbium and yttrium, according to the company’s PEA.

Outlook for rare earth juniors

At the 2013 Vancouver Resource Investment Conference, John Kaiser of Kaiser Research gave Rare Earth Investing News his take on which — and how many — rare earth juniors are likely to succeed. He noted that companies focused on heavy REEs have a better chance of survival, commenting that Quest Rare Minerals and Tasman Metals both have a good chance at success.

Market round-up

China’s praseodymium-neodymium oxide market is in deadlock and business is thin, according to a report by Metal-Pages.

Market sources confirmed that prices for 99-percent praseodymium-neodymium metal remain at around $64,370 to $65,980 per tonne — unchanged compared with last week’s prices.

A producer based in Northern China confirmed that it has halted production and will begin again following the Chinese New Year holiday.

“We have no new orders. The market will be stable before the Chinese New Year and we except prices to rise after the festival,” he said.

Lanthanum oxide business is said to be thin on the Chinese spot market, as optical glass producers, the main downstream consumers, have postponed buying.

Prices for 99-percent grade lanthanum oxide are in the range of $6,900 to $7,200 per tonne.

A trader based in Southern China confirmed that he will not be restocking because consumers are reluctant to buy at higher prices.

“We are staying on the sidelines for the time being because we will not restart production before March,” a producer in Southern China said.

China’s europium oxide market is stagnant, with prices unchanged as the Chinese New Year holiday approaches. Industry sources have noted that participants will focus more on the market after the holiday.

Company news

Great Western Minerals Group reported on the status of its diamond drilling program at Steenkampskraal.

Objectives of the program include step-out drilling to investigate extension of the main monazite zone; infill drilling on areas of lower data density to upgrade inferred mineral resources to the indicated category; and selected orientated core drilling for geotechnical analyses in support of planned underground developments, according to a press release.

In addition to the drilling, Great Western has initiated exploration activities on the surrounding prospecting right, a 550-square-kilometer area that encompasses Steenkampskraal and hosts historic occurrences of monazite at surface.

Search Minerals announced results from the NQ drilling program on its Pesky Hill prospect in Labrador.

A company press release notes that heavy REE-zirconium-yttrium-niobium vein-hosted mineralization was intersected and that 38 shallow vertical holes ranging from 26 to 50 meters in depth were drilled as part of the phase-one exploration NQ drilling program.

The release also confirms that the zirconium showing contains some of the highest grade heavy REE vein mineralization and is open at depth.

Texas Rare Earth Resources engaged a representative to help determine possible strategic alternatives for its Round Top project.

The representative was hired in response to a preliminary indication of potential interest from a multi-billion-dollar resource firm located in Asia, according to the company’s press release.

Texas Rare Earth’s CEO, Dan Gorski, said, “[g]iven the interest level in our unique Round Top project, the Board felt it necessary to engage a representative to further explore potential interest from Asia. Demand for heavy rare earth elements is expected to continue to outstrip supply in the years to come. Given that the vast majority of such elements are used in the Asian regions, it is logical that interest from the region could be quite robust.”

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Poor Radioactive Waste Handling at Malaysian Rare Earth Refinery

- Details

- Category: Rare Earth News

- Published on Thursday, 31 January 2013 17:13

- Hits: 1738

German environmental research group, the Oeko-Institute has published a report criticising Australian Rare Earth mining company, Lynas Corporation's refining facility in Malaysia which is critical of its environmental impact and its poor storage of radioactive wastes.

According to the researchers, the storage of radioactive and toxic wastes on site does not prevent leachate from leaving the facility and entering ground and groundwater.

The report, conducted on behalf of the Malaysian NGO SMSL, found that the site lacks a sustainable concept for the long-term disposal of radioactive wastes under acceptable conditions.

The facility in Kuantan, Malaysia refines ore concentrate for rare earth metals. These strategic metals are used to produce catalysts, nickel metal hydride batteries and permanent magnets. The Institute point out that a number of emerging key- and future-technologies depends from the supply of these rare earths.

However, the ore concentrate being refined at the site also contains toxic and radioactive constituents such as Thorium.

The Oeko-Institute said that it was commissioned to perform a study to check whether the processing of the ore leads to hazardous emissions from the plant or whether dangerous waste will remain in Malaysia.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Equity Rally Should Boost Discounted Rare Earth

- Details

- Category: Rare Earth News

- Published on Friday, 01 February 2013 16:18

- Hits: 2906

Jeb Handwerger: I notice with interest that the popular media is ignoring the World Trade Organization case against China for restricting exports of critical materials. This reduction of supply of the critical metals has a significant impact on the global economy.

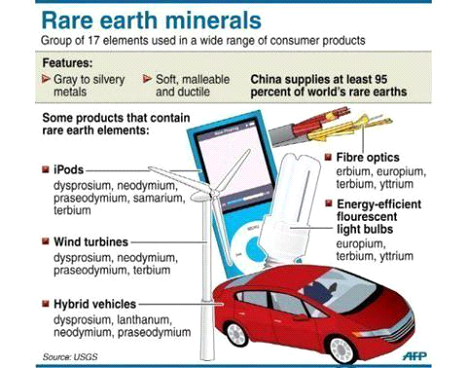

These critical metals are not only crucial for your iPads and smartphones, but for our top secret, most advanced weaponry. Looking for substitutes for rare earths has proven to be a poor return on investment. For 50 years, they have been trying to find alternatives, only to find out that the chemical characteristics of rare earths are inimitable.

I have been a major proponent of advancing domestic strategic mines in the U.S. and Canada. Recently, the U.S. Department of Defense partnered with one of our rare earth recommendations to advance studies.

This move may show investors that the our national security is dependent on domestic critical rare earth production. I would not be surprised to see Canada make a similar move to support rare earth mining and development.

Recently during the quiet holiday season, China announced that they were tightening exports again on critical materials. Rare earth export quotas for next year will drop again. China claims that they are cutting back because of the weak global economy.

Nevertheless, stealthily China continues to announce infrastructure plans within the country, and has been stockpiling these critical materials for their own domestic demand. For months, we have been predicting a rebound in China’s economy as iron ore prices began rising.

Now we read headlines that China’s exports are very strong, even with a rising yuan . Risk assets such as the rare earths miners and uranium miners should rally on this news. More smart money from the investment community is realizing that China is far from a hard landing. In fact, they may be in the midst of a powerful recovery.

Exports have jumped to a seven-month highs despite the debt issues in Europe and the United States. This rebound in China may be a spark for the undervalued junior miners, which have been in a downtrend for close to two years as economists predicted a Chinese hard landing.

Many investors have been concerned about the recent Fed minutes, which indicated some sort of exit plan from quantitative easing. These accommodative actions to expand the Fed’s balance sheet to record levels have boosted bonds, the housing and the financial markets with easy money.

We may be witnessing capital flowing to growing economies such as China. All these actions over the past few years by Central Banks could be starting an inflationary cycle, which could boost the undervalued commodities such as uranium and industrial/strategic metals.

China’s equity markets are up around 20% in the past six months, far outpacing equity markets in Europe and the United States. Many do not realize yet that not only is China the world’s biggest supplier, but their own economy has grown to a point where they may become the largest consumer of these materials as major industries continue to move their factories to China.

China continues to control the rare earth industry despite attempts from companies like Molycorp and Lynas to begin production. Both companies have been plagued by delays and obstacles. Mining and refining rare earths is not an easy ballgame, as it requires advanced metallurgy and favorable geopolitics.

For decades, the world has been relying on cheap rare earths from China. Nevertheless, this will change rapidly over the next few years. The Chinese are especially short on the critical rare earths needed for permanent magnets, wind turbines, guided missiles and lighting, as they are building their own facilities to manufacture these finished products.

Molycorp and Lynas should be able to supply a large amount of light rare earths after they work out their issues. However, Lynas is still dealing with protestors in Malaysia, and Molycorp is dealing with delays and rising costs to start production. The disappointing performance in these two equities has hurt the entire sector.

In 2011 and 2012, we experienced a decrease in the price of the entire industrial metal sector as QE2 expired and the U.S. and European debt crisis intensified. However, we may be at a turning point for the undervalued rare earth and uranium miners as China leads a rebound.

Large amounts of quantitative easing in the U.S. were announced in the second half of 2012. The new Japanese government is also devaluing the yen to boost the Nikkei, while restarting nuclear plants. China is rebounding quickly, announcing infrastructure projects and starting construction on nuclear reactors. China is leading the world with building new reactors.

China’s decreasing rare earth exports, combined with declining production and rapidly depleting heavy rare earth resources, could cause an even greater supply shortfall in 2013. China is consolidating the rare earth industry and cutting down on critical metal smuggling. This will help the Chinese have greater control of their own domestic production.

I will closely follow in my free newsletter both the critical heavy rare earth space and the uranium sector as Asia rebounds, as these metals are crucial for China’s domestic needs. These rare metals are vital for our latest high tech devices, and there are only a few viable companies that can get into production in a timely manner.

In the rare earth mining sector, geopolitical support and infrastructure is crucial. In the uranium space, rising geopolitical tensions in Africa and the Middle East with Al Qaeda could cause increased interest in junior uranium developers in the Western Hemisphere.

Two ways of investing in these sectors is through the Rare Earth ETF and the Uranium Miners ETF. Both of these metals are critical for China’s clean energy initiatives and Middle Eastern energy independence. The ETFs were poor performers in 2012 as fears of a slowdown in China increased. Now, they may represent bottoming situations, which I will be following closely for my readers.

From http://etfdailynews.com

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

Avalon Rare Metal's Rare Earth Elements Project Feasibility Study for Completion in Q2

- Details

- Category: Rare Earth News

- Published on Thursday, 31 January 2013 17:04

- Hits: 2772

Avalon Rare Metals Inc. is pleased to provide a progress report on the Company's Feasibility Study and related work on the Nechalacho Rare Earth Elements Project at Thor Lake, NWT (the "Project").

Feasibility Study

The Feasibility Study ("FS") for the Project, including the operations at Thor Lake and Pine Point, NWT and Geismar Louisiana remains on schedule for completion in Q2 2013. The following key elements of the FS have been completed:

Environmental Baseline work at Nechalacho and Pine Point;

Underground Mine plan and development schedule;

Tailings Facility;

Paste Backfill Plant;

Nechalacho Flotation Plant designs; and

Geismar Separation Plant designs.

Capital and Operating cost estimates are largely complete for those components of the Project where engineering design work is finished. Design criteria for the Pine Point Hydrometallurgical plant have been prepared and design work is now advancing on schedule.

Product Marketing

Avalon continues its efforts to secure product off-take agreements and in this regard, the Company is pleased to announce the signing of a Memorandum of Understanding (MOU) with an Asian company for the sale of its Enriched Zircon Concentrate ("EZC") product. The EZC contains most of the zirconium, tantalum, niobium recovered and approximately 15-20% of the rare earths. Samples of the EZC were initially sent to this prospective customer in August 2012 and successful processing tests led to the signing of this MOU in January 2013. The revenue from the EZC is expected to represent a significant percentage of the total revenue from the project. Negotiations for off-take agreements for the sale of separated rare earth oxides and carbonates are progressing.

Metallurgical Testwork

The Hydrometallurgical plant testwork program is virtually complete except for some minor impurity removal and kiln optimisation investigations. Mintek SA in Johannesburg, RSA is in the process of optimising final impurity removal processes ahead of completing a mini pilot plant campaign for the rare earth separation and refining operations. Process optimisation testwork for the flotation plant continues as opportunities to improve flotation performance are investigated. Various alternative reagent combinations will continue to be evaluated in an effort to reduce reagent consumption and enhance recoveries.

Rare Earth Manufacturer & Supplier: Chinatungsten Online - http://www.chinatungsten.com

Tel.: 86 592 5129696; Fax: 86 592 5129797

Email: sales@chinatungsten.com

Tungsten News & Tungsten Prices, 3G Version: http://3g.chinatungsten.com

Tungsten News & Tungsten Prices, WML Version: http://m.chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com