China's Tungsten Market in the First Half of 2025

- Details

- Category: Tungsten's News

- Published on Monday, 30 June 2025 19:31

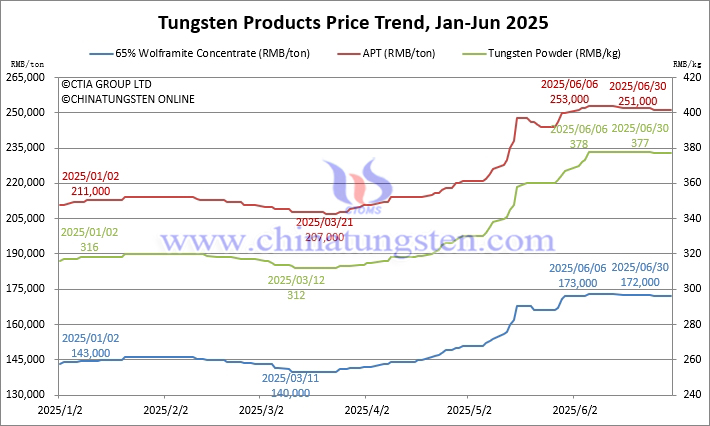

In the first half of 2025, under the influence of structural tightening on the supply side, rigid support from downstream demand, and the interweaving of international geopolitical risks, China's tungsten market showed a composite operating characteristic of "fluctuating upward-repeatedly setting new highs-periodic correction-high-level fluctuations".

(I) Analysis of Tungsten Price Fluctuations and Their Driving Factors

January: Supported by the Spring Festival effect, tungsten prices rose moderately. Affected by factors such as concentrated factory maintenance and holidays before the Spring Festival, the supply of tungsten raw materials and products has tightened, supporting tungsten prices to show a moderate upward trend. The price of tungsten ore increased by about 2.1% during the period.

Early February to early March: Export control impact, tungsten prices were under pressure to fall. The export control measures for tungsten and molybdenum-related items implemented on February 4 (Event 1) had a significant impact on the market. The obstruction of export channels has put pressure on some manufacturers that rely on overseas orders. As a result, China's tungsten prices have experienced a downward adjustment cycle of about one month, during which the price of tungsten ore fell by about 4.1%. However, this incident also triggered concerns about the stability of the supply chain in the international market, pushing up the international tungsten price sharply.

Late March to mid-May: Policies and resource scarcity resonated, and tungsten prices rose strongly to a record high. This stage became a decisive turning point in the first half of the year. There are two core driving factors: First, China's first batch of tungsten mining total control indicators in 2025 were reduced by 4,000 tons (Event 2). This unexpected supply contraction policy strengthened the market's expectations of long-term shortages of raw materials. Second, the continued escalation of geopolitical tensions in the Middle East and other regions (Event 3) has intensified global concerns about the security of supply of key strategic metal resources, including tungsten, and its strategic attributes have been repriced and highly concerned by the market. Domestic and foreign factors have formed a strong resonance, pushing tungsten prices (especially the raw material side) to start a rapid rise mode, constantly breaking through historical highs. The maximum amplitude of tungsten ore prices during the cycle reached +20%, and tungsten materials, cemented carbide, tungsten alloys and other companies have repeatedly raised product prices under the influence of cost factors.

Late May to early June: After a brief correction, tungsten prices rose again. After the tungsten price hit a record high, the market saw a short period of profit-taking and technical correction demand. However, supported by strong supply constraints and tungsten raw material costs, the correction was limited and short-lived. Tungsten prices quickly regained their upward trend, repeatedly refreshing historical peaks. The price of 65% black tungsten concentrate peaked at RMB 173,000/ton, the price of ammonium paratungstate (APT) peaked at RMB 253,000/ton, and the price of tungsten powder peaked at RMB 378,000/ton.

From late June to now: high-level consolidation, intensified game. In late June, the tungsten market entered a high-level oscillation stage. On the one hand, the continued high prices put pressure on the cost transmission of downstream alloy and cemented carbide companies, and demand in some areas showed signs of fatigue, and procurement tended to be cautious; on the other hand, upstream mines were still willing to support prices under strong policy constraints and cost support. Both supply and demand sides entered a period of deep game, and prices showed a trend of sideways consolidation after a slight correction. Despite this, the market generally believes that tungsten prices still have the potential to explore higher prices in the context of unresolved core supply constraints and prominent strategic value.

(II) Interpretation of the Impact of Key Events

Event 1: On February 4, China implemented export controls on tungsten, molybdenum and other related items.

Impact: (1) It caused a sharp decline in China's tungsten product exports (APT and tungsten trioxide exports were zero from March to May), and the supply in China increased relatively in the short term, and the tungsten price was under pressure to fall for about a month. (2) It caused strong concerns in the international market about the stability of China's tungsten supply chain, stimulated a sharp rise in international tungsten prices, and formed a divergence between domestic and foreign prices. (3) It forced the development of alternative tungsten mineral resources overseas. (4) It drove Chinese companies to accelerate their expansion into downstream deep processing fields and turn to the production of high-value-added products such as high-end cemented carbide to reduce the impact of export restrictions and maintain and expand their international market share.

Event 2: On April 3, the Ministry of Natural Resources issued the first batch of tungsten mining total control indicators for 2025, which was 58,000 tons, a year-on-year decrease of 4,000 tons, a decrease of 6.45%.

Impact: The data released a signal that the country will strengthen the control of tungsten resources and protect strategic mineral resources, exacerbating the expectation of tight global tungsten concentrate supply, and providing policy and emotional support for the upward trend of tungsten prices.

Event 3: The escalation of geopolitical tensions in the Middle East and other regions

Impact: The intensification of geopolitical risks highlights the irreplaceability of tungsten as a key strategic metal. Its wide application in defense, military industry, high-end manufacturing, new energy and other fields has made it a focal resource in the game between major powers. The tense situation has pushed up global anxiety about strategic resource reserves and supply chain security, further strengthened the resource attributes and investment value of tungsten, and became an important external factor in pushing up tungsten prices (especially international prices).

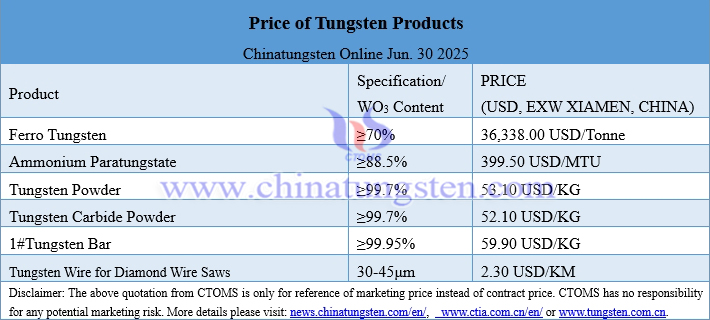

As of June 27, the price of European tungsten iron was USD 51.5-52/kg W, up 17.6% from the beginning of the year. The price of European APT was USD 440-485/ton, up 40.2% from the beginning of the year.

- Chinatungsten Online: www.chinatungsten.com

- CTIA GROUP LTD: en.ctia.group

- Tungsten News & Price: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Email: sales@chinatungsten.com