Clean Energy Transition to Drive Growth for China's Rare Earth Industry in 2022

- Details

- Category: Tungsten's News

- Published on Monday, 14 February 2022 22:20

China has long had a strong presence in the rare earth industry, but after years of heavy mining, its share of global production and reserves has declined significantly. World reliance on Chinese rare earths is gradually slowing, but China is expected to continue to increase its production, exports, and pricing of rare earths through 2022, driven by increased global demand for clean energy.

"The upward trend in Chinese rare earth prices, production, and exports will definitely continue through 2022," Yang Wenhua, an analyst at data provider Shanghai Metal Market, said in an interview. "The global shortage of rare earths is likely to continue until 2025 as governments strive to transition to a low-carbon economy."

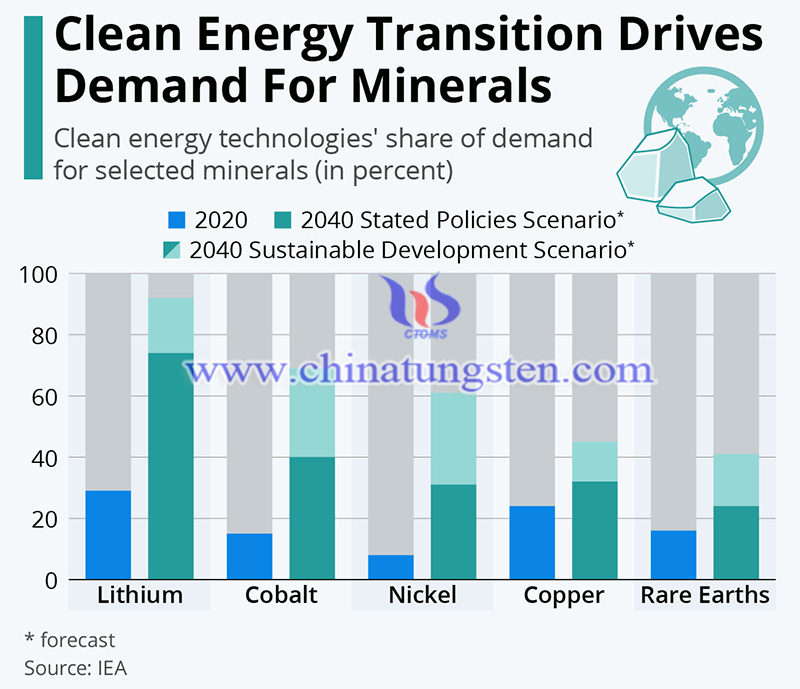

According to the International Energy Agency, the world's demand for rare earth elements could be three to seven times higher than current levels by 2040.

our country recently increased its first batch of rare earth mining production quotas for 2022 by 20% year-on-year to 100,800 tons, amid surging demand for renewable energy. Our country publishes quotas twice a year, including quotas for mining the more common light and heavy rare earths. Chinese rare earth exports jumped 38% to 48,918 tons in 2021, the highest since 2018, data from the General Administration of Customs showed.

Yang said our country is unlikely to significantly increase its quota for rare earth output, especially heavy rare earths, because of environmental requirements and national strategy. Quotas for heavy rare earth elements have remained unchanged for more than three years. Heavy rare earth elements such as dysprosium and terbium are critical to defense and medical technology, but their production processes can be highly polluting.

Chinese rare earth exports are expected to grow 30 percent in 2022, while annual production will likely increase 20 percent. Prices will also remain high in 2022, Young said, with prices for neodymium and praseodymium oxides jumping more than 75% and 143%, respectively, as of Dec. 28, 2021, according to S&P Global Market Intelligence. Neodymium and praseodymium oxides are used in permanent magnets, a key material for electric vehicles.

"Chinese dominant position in rare earth resources has gradually declined with the emergence of a worldwide rare earth exploration boom and the massive mining of rare earth resources," wrote a team led by Zheng of the Chinese Academy of Geological Sciences in a March 2021 article.

According to the USGS, our country accounts for 60% of global rare earth production in 2021, down from 97.7% in 2010. Meanwhile, Chinese share of global reserves falls to 36.7 percent in 2020, compared to 50 percent in 2010.

Chinese market players are keeping a close eye on overseas rare earth supplies, and among the new entrants, Africa is most likely to be a significant source of rare earths, Yang said. Despite its limited capacity, Africa is the only region outside of China where the entire e-waste recycling chain has been established.

Chinese companies enjoy lower production costs for rare earths and relatively lenient environmental policies. Our country has spent decades developing a complete supply chain, including upstream separation, smelting facilities, and magnet plants, as well as ancillary materials such as phosphoric acid, sodium hydroxide, and oxalic acid. China has also been working to consolidate the rare earths industry to increase pricing power and improve management efficiency.

Despite the increasing global demand for rare earths of the clean energy transition, starting new refining facilities in regions such as the U.S. has been difficult. Many companies face a myriad of challenges, including permitting, lack of financing for upstream mining and refining projects, and stiff competition with established Chinese producers.

The U.S. government has flagged its reliance on rare earths as a potential risk to national security because of the important applications of rare earths in defense technology.

In February 2021, the U.S. Department of Defense awarded $30.4 million to Australian rare earth elements mining and processing company Lynas Rare Earths Ltd to build a processing facility in Texas to strengthen the defense supply chain. And in April 2021, the U.S. Department of Energy awarded $19 million for 13 projects across the country related to the production of rare earths and critical minerals.

More recently, U.S. Rep. Mike Kelly, R-Pa., and Sen. Tom Cotton, R-Ark., introduced legislation in January to bring rare earth industry back to U.S. shores. If passed, the bill would create a strategic rare earth reserve. While a number of countries have implemented a number of policies targeting the supply of rare earths, the clean energy transition is still predicted to drive growth in China's rare earth industry through 2022.

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com