Chinese Tungsten Prices Stabilized While European Tungsten Market Was Quiet

- Details

- Category: Tungsten's News

- Published on Friday, 19 July 2019 19:18

Analysis of latest tungsten market from Chinatungsten Online

Tungsten markets globally were squeezed from oversupply and lack of demand from the automotive, cemented carbide and special alloys industries, resulting in falling prices. The sharpest decline was noted in China, the world's top producer.

However, with the sharp contraction of profits in the first half of the year and the tightening availability of raw materials after the company stopping production, mainstream tungsten prices in China now tend to stabilize and are expected to bottom out in the short term.

European tungsten prices have declined since the start of second quarter albeit at a slower pace than Chinese prices as deteriorating US-Sino trade relations, weak demand and oversupply weighed on global markets.

Prices for ammonium paratungstate (APT) fell by 9.3pc between January and 11 July in Europe, compared with the Chinese market, which erased nearly a quarter of its value over the same period, Argus data show. European APT prices have fallen by 29.4pc since July last year, but Chinese prices have posted sharper falls, sliding by 41.1pc.

The European tungsten market was largely quiet over the second quarter, with many users consuming material from their long-term supply contracts, resulting in limited buying interest and weak spot demand.

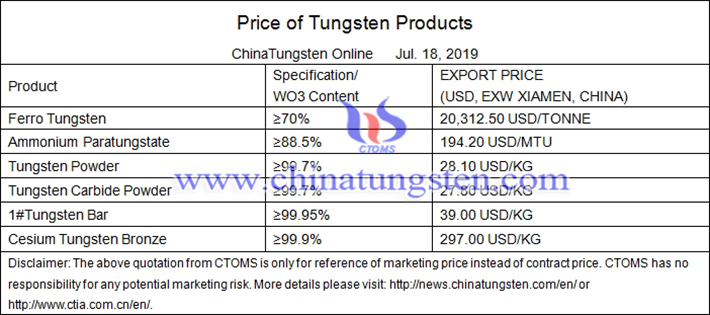

Prices of tungsten products on July 18, 2019

Picture of tungsten powder

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com