China Tungsten Concentrate Price Down Again; APT Price Stabilized

- Details

- Category: Tungsten's News

- Published on Friday, 31 May 2019 18:04

Analysis of latest tungsten market from Chinatungsten Online

Chinese tungsten prices continue to show signs of decline in the week on Thursday May 30. The market expects the linkage effect of rare earth prices to drive up spot prices, but it seems hard to achieve as some traders seek for more sales under capital shortage and pressure of sales.

Environmental protection supervision and the reduction of smelter production will help to ease the company's inventory pressure, but the current market still needs downstream users to enter the market to purchase and cooperate. Recently, the tungsten market maintains a stagnant state of production and sales as a whole.

In the tungsten concentrate market, the supply becomes tight on environmental checks and joint production reduction of enterprises. Downstream factories remain low buying appetite for raw materials, so tungsten concentrate prices continue to remain weak adjustment, gradually approaching the cost line of environmental protection and resource grade decline.

The slump demand side affects the price rebound in the ammonium metatungstate (APT) market. APT price remain volatile and the spot trading was basically concluded below $256/mtu of offer levels of large tungsten companies, and some of them even touched down to $247.2/mtu. Smelting factories face pressure of price inversion and have no enough power to produce products. Traders have different attitudes towards the market in June and mainly take a watchful stance when market quotations are in the chaos.

The tungsten powder market continues its fundamental weakness. Downstream alloy and product enterprises remain low trading activity with relatively pessimistic sentiment. Sino-US trade frictions, supply and demand game and corporate bidding are still impacting market confidence, and the volume of trading in the market continues to decline.

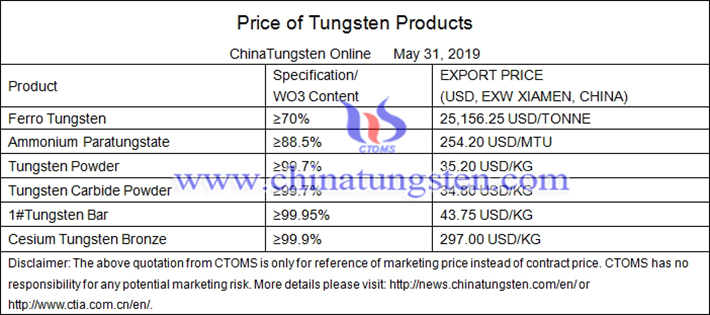

Prices of tungsten products on May 31, 2019

Picture of tungsten powder

Follow our WeChat to know the latest tungsten price, information and market analysis.

- Tungsten Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com