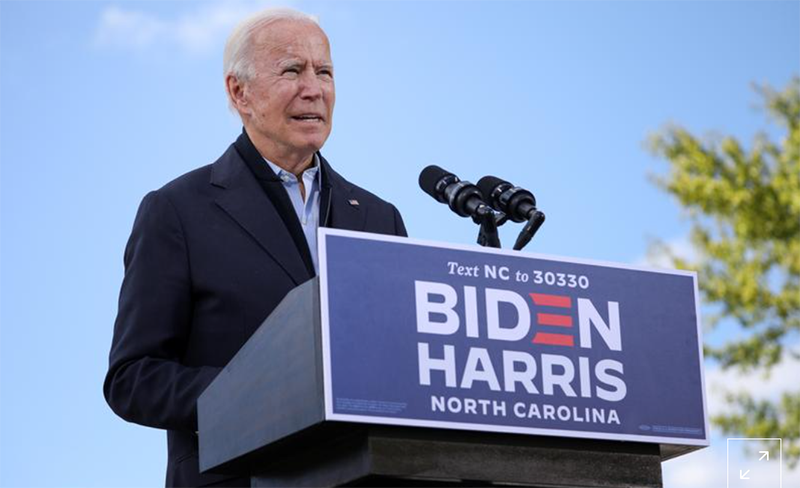

Biden Campaign Tells Miners It Supports Rare earths, Cobalt, and Nickel Production

- Details

- Category: Tungsten's News

- Published on Monday, 26 October 2020 12:18

Joe Biden's campaign team had privately promised to miners that they would support them in expanding domestic metal production capacity, such as rare earths, cobalt, and nickel to support the needs of green energy industries such as electric vehicles (EVs) and solar energy, according to market hearsay. It is worth noting that the sharp rise in the prices of cobalt and nickel has driven the metal index of EVs to climb to the highest peak since 2020.

Reuters exclusively quoted an unnamed source on Oct 23 to report that former US President Barack Obama had implemented strict environmental regulations and slowed down the development of the US mining industry during his tenure. The market thought Biden, would stick to the Obama line.

However, the latest news shows that in addition to approving the expansion of U.S. production capacity by miners, Biden also supports the two parties' plans to build a supply chain of strategic raw materials such as lithium, copper, rare earths, and nickel in the country. The US currently imports these materials from countries such as China. Lithium Americas Corp., Albemarle Corp., Standard Lithium Corp., and other lithium miners are regarded as the beneficiaries of Biden's election.

According to sources, Glencore Plc, the world's largest commodity trader that controls Minnesota miner PolyMet Mining Corp., regards the development of a copper mine in Minnesota as a long-term investment, even if Biden wins the election, it does not intend to cut its investment. This implies that the mining industry believes that Biden's policies would be friendly.

The current President Donald Trump has issued an executive order to reward mining activities in the US. According to sources, although Biden agrees with Trump's encouragement of the domestic mining industry, he does not support Trump's anti-China policy and actions to simplify federal approval procedures. Biden has previously stated that if he wins the election, he intends to spend US$2 trillion to develop green energy solutions such as EV infrastructure.

MINING.COM reported on the 21, the EV Metal Index has recently jumped to its highest peak since 2020 after falling to its lowest level since January 2018 in April.

Adamas Intelligence, a market research agency, tracks chemical, battery suppliers, and production capacity in more than 90 countries. According to data from the agency, during August, the amount of lithium used in newly sold EVs increased by 58%. Since the introduction of EVs, lithium consumption has increased promptly. The consumption of nickel and cobalt for cathode materials increased by 46% annually, and the consumption of graphite for anode materials increased by 61% annually.

Biden campaign’s supports on rare earths, cobalt, and nickel production may help to release the mineral tensions in the US. According to Benchmark Mineral Intelligence data, the average price of cobalt increased by 31% to US$40,000 in August, mainly due to the delay in exports of metal from the Republic of Congo through South Africa. Not only that, but China's State Bureau of Materials Reserves is also buying cobalt as a strategic inventory of the country, pushing the price up further.

- Rare Earth Manufacturer & Supplier, Chinatungsten Online: www.chinatungsten.com

- Tungsten News & Prices of China Tungsten Industry Association: www.ctia.com.cn

- Molybdenum News & Price: news.molybdenum.com.cn

- Tel.: 86 592 5129696; Fax: 86 592 5129797; Email: sales@chinatungsten.com

sales@chinatungsten.com

sales@chinatungsten.com